Stocks are extending last week's troubling performance

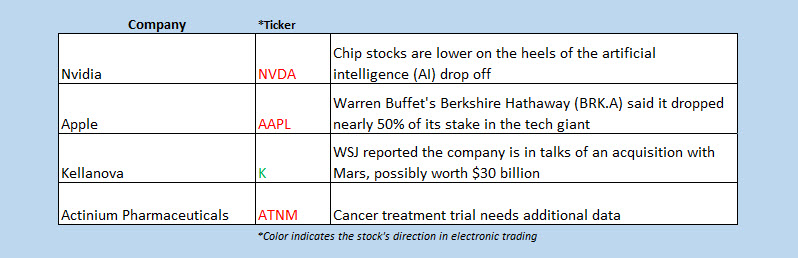

Recession fears continue to rock Wall Street this week, with futures on the Nasdaq-100 Index (NDX), Dow Jones Industrial Average (DJIA), and S&P 500 Index (SPX) sharply lower before the bell. Extending the pullback that followed last week's disappointing jobs data, investors are continuing to retreat from Big Tech, with Apple (AAPL) leading the way after Berkshire Hathaway (BRK.A) cut 49% of its stake in the iPhone maker.

Continue reading for more on today's market, including:

5 Things You Need to Know Today

- The Cboe Options Exchange (CBOE) saw more than 2 million call contracts and 1.6 million put contracts exchanged on Friday. The single-session equity put/call rose to 0.81, while the 21-day moving average remained at 0.66.

-

Coinbase Global Inc (NASDAQ:COIN) is down nearly 20% before the bell, suffering a steep selloff alongside

crypto leader Bitcoin (BTC). BTC was dragged below the key $50,000 mark for the first time in 2024. Heading into today, however, Coinbase stock boasted a 17.5% lead.

-

Software giant Palantir Technologies (NASDAQ:PLTR) is off more than 15% to trade at $20.90 premarket, with investors anticipating its earnings report, slated for after the close. The shares pulled back Friday, captured by the ascending 80-day moving average. For 2024, PLTR has added 44%.

-

Lucid Group Inc (NYSE:LCID) is another security suffering pre-market losses ahead of its earnings report, the shares down 8% at $3.12 ahead of the open. A loss per share of 27 cents is estimated for the auto manufacturer, which has already shed 54% over the last 12 months.

-

The S&P final U.S. services purchasing managers' index (PMI) and ISM services index are

due out today.

Japan Suffers Worst Day Since "Black Monday" Crash

Asian markets settled firmly lower on Monday. Japan’s Nikkei shed 12.4% for its worst day since the “Black Monday” crash in 1987, brushing off a stronger yen and turning negative for the year, while South Korea’s Kospi lost 8.8%. Elsewhere, investors unpacked better-than-expected July services data out of China and a rising purchasing managers’ index (PMI) reading. Nevertheless, China’s Shanghai Composite and Hong Kong’s Hang Seng both fell 1.5%.

European markets are also in the red amid recession fears and sinking oil prices. Services data for July is in focus as well, with the U.K.’s PMI reading beating analysts’ estimates, while similar data out of Italy and Spain suggested growth. Still, the German DAX is down 3.3%, London’s FTSE 100 is 2.9% lower, and France’s CAC 40 is off 2.6%.