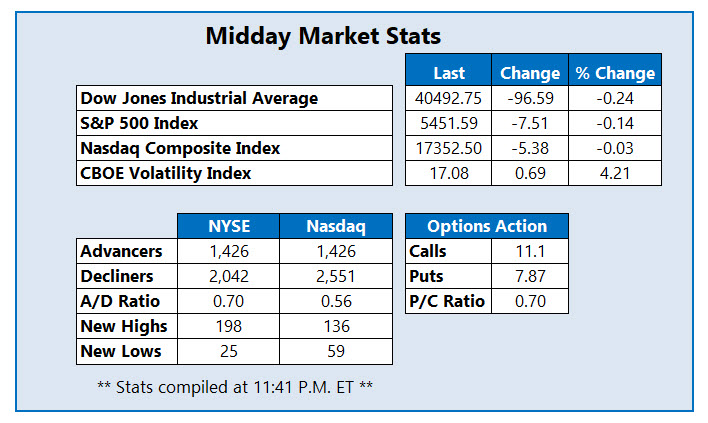

The Dow is off by almost 100 points this afternoon

The Dow Jones Industrial Average (DJIA) is 96 points lower today, pulling back from Friday’s 654-point pop, while the S&P 500 Index (SPX) and Nasdaq Composite Index (IXIC) sit quietly in the red as well. Investors are looking ahead to this week’s tech earnings -- especially after last week’s sector slump -- and the Federal Reserve’s two-day policy meeting that kicks off tomorrow. Meanwhile in Washington D.C., President Joe Biden revealed his plan to reform the Supreme Court.

Continue reading for more on today's market, including:

Options traders are blasting McDonald’s Corp (NYSE:MCD), as the fast food stock rises despite disappointing second-quarter results and a drop in global sales for the first time in three years. So far, 53,000 calls and 39,000 puts have been exchanged, which is nearly triple the average daily options volume. The August 280 call is the most popular, followed by the weekly 8/2 250-strike put, with new positions opening at both. At last look, MCD was up 3.5% at $260.81 and running into its 80-day moving average.

The New York Stock Exchange’s (NYSE) Koninklijke Philips NV (NYSE:PHG) is soaring to two-year highs today, up 12.9% at $29.07 at last glance, after the health technology company announced strong second-quarter growth and a positive forecast. Year to date, the equity sports a 28.7% lead.

Utility stock Centuri Holdings Inc (NYSE:CTRI) is one of the worst performing stocks on the NYSE today, though the reason is unclear given the company’s better-than-expected second-quarter results. Down 23% at $15.58 and on the short sell restricted (SSR) list, the newly publicly traded stock is hitting record lows.