Investors are still contending with higher Treasury yields

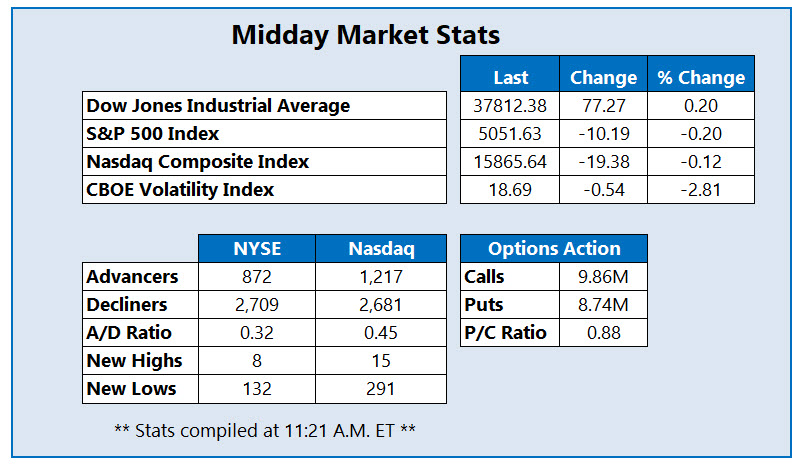

The S&P 500 Index (SPX) and Nasdaq Composite (IXIC) are slipping into negative territory this afternoon, while the Dow Jones Industrial Average (DJI) is clinging to a modest lead thanks to upbeat quarterly results from blue chip UnitedHealth (UNH).

Investors are unpacking the latest batch of bank earnings as they contend with higher Treasury yields. Wall Street is also anticipating comments from Federal Reserve Chair Jerome Powell, who will speak at the Washington Forum on the Canadian Economy later today.

Continue reading for more on today's market, including:

Deutsche Bank raised its price target on Keurig Dr Pepper Inc (NASDAQ:KDP) stock to $34 from $33 today. Though the stock was last seen near breakeven at $30.45, more than 15,000 puts have already crossed the tape -- 10 times the volume typically seen at this point -- compared to just 262 calls. The most popular contract by far is the April 28 put. KDP was recently turned away by its 80-day moving average and over the last 12 months, the beverage stock has shed 14.1%.

Macatawa Bank Corp (NASDAQ:MCBC) is up 39.1% to trade at $13.82, among the best stocks on the New York Stock Exchange (NYSE) today. Shares earlier hit a 16-year high of $14 and blasted through resistance from the 60-day moving average, following news that Wintrust Financial (WTFC) will acquire the bank name for $510.3 million. MCBC is up 21.9% this year.

First Majestic Silver Corp. (NYSE:AG) is near the bottom of the NYSE, on the short sell restricted list and last seen off by 9.2% to trade at $6.79. The silver miner is taking a hit in concert with the safe-haven asset, as interest rate cut hopes fall. AG is up 10.9% in 2024.