Volatile trading is likely amid triple witching expiration

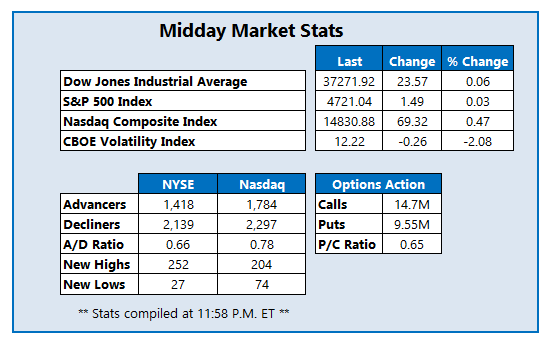

Both the Dow Jones Industrial Average (DJI) and S&P 500 Index (SPX) are flat this afternoon, but are still eyeing seven-straight weekly gains -- the longest such streak since 2019 for the former, and 2017 for the latter. Meanwhile, the Nasdaq Composite (IXIC) is sporting a solid lead and eyeing a seventh consecutive week in the black as well. Volatile trading is likely amid triple witching expiration, as well as the S&P 500 and Nasdaq-100 Index (NDX) rebalancing.

Continue reading for more on today's market, including:

- 3 solar stocks surging on bullish coverage.

- Mixed quarterly results weigh on Lennar stock.

- Plus, earnings beat draws bulls to COST; surging mining stock to watch; and worst NYSE name today.

Costco Wholesale Corporation (NASDAQ:COST) announced better-than-expected fiscal first-quarter earnings and revenue on strong demand for cheaper grocery items. No fewer than 15 brokerages hiked their price objectives in response, with Jefferies and UBS lifting to $725 from $680 and and $640, respectively. So far today, 66,000 calls and 33,000 puts have been exchanged , or seven times the intraday moving average. The December 660 call is most popular, with positions being opened there. COST is up 43.7% so far this year, and was last seen up 3.4% to trade at $652.92.

Compania de Minas Buenaventura SAA (NYSE:BVN) was last seen up 23.9% at $12.38, at the top of the New York Stock Exchange (NYSE). The catalyst behind the massive surge for the Peruvian mining stock is unclear. The shares are trading at their highest level since March 2022, and pacing for their biggest single-day percentage win since March 2020. BVN is up 64% this year.

Bright Health Group Inc (NYSE: BHG) stock is dangerously close to penny stock territory, down 14.2% to trade at $6 at last check, and also at the bottom of the NYSE. Shares have been trading sideways since August, as they struggle with pressure from the 100-day moving average. Additionally, the security also carries a hefty 88.5% year-to-date deficit.