Oil prices are moving higher as Hurricane Idalia hits Florida

Stocks are modestly higher this afternoon, as the market looks to extend this week's rally. Should the Dow Jones Industrial Average (DJI) secure its fourth-straight gain today, it would be its longest win streak this month. Investors are still unpacking the latest ADP employment report and gross domestic product (GDP) data, both of which were lower than expected. Meanwhile, oil prices are rising after a drop in U.S. crude inventories, and as Hurricane Idalia hits Florida.

Continue reading for more on today's market, including:

- Semiconductor stock downgraded on long-term strategy.

- Box stock attracts bear notes due to weak guidance.

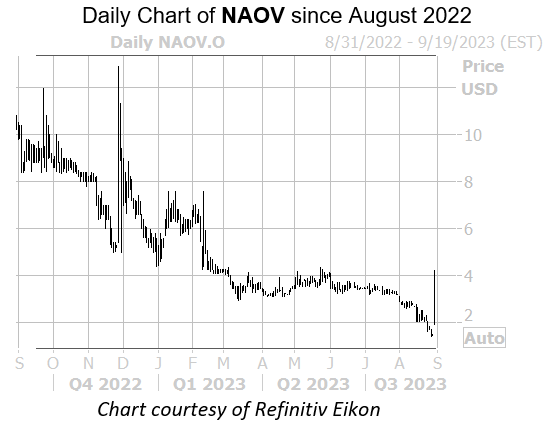

- Plus, unpacking AMBA's options activity; NAOV soars; and annual forecast weighs on MCFT.

Options traders are targeting Ambarella Inc (NASDAQ:AMBA) today, with 9,242 calls and 12,000 puts exchanged so far, which is already 19 times the stock's average daily options volume. The weekly 9/1 55-strike put is the most popular, with positions being opened there. AMBA was last seen down 17.9% to trade at $62.21, after the company shared a disappointing fiscal third-quarter revenue forecast and saw a downgrade to "market perform" from "outperform" at TD Cowen. No fewer than eight other analysts slashed their price targets as well. AMBA is down 24.4% this year.

NanoVibronix Inc (NASDAQ:NAOV) is at the top of the Nasdaq today, up 154.5% at $3.69 at last check, after the medical equipment company shared positive results from independent testing of its UroShield. The stock had never touched penny stock territory before December, and is still down 33.1% since the start of 2023.

Meanwhile, Mastercraft Boat Holdings Inc (NASDAQ:MCFT) is down 12.6% at $21.80 at last check, despite strong fiscal fourth-quarter results, after the company cut its annual guidance due to slow demand. Now trading at its lowest levels since October, MCFT is on track for its fifth-straight weekly loss, while carrying a 15.7% year-to-date deficit.