All three major indexes are below breakeven

Stocks were last seen slightly below breakeven as Wall Street unpacks today's economic data and slew of corporate earnings reports. Jobless claims fell to 239,000 from last week's seven-week highs, while the leading economic index fell 0.4% in July for its 16th-straight monthly decline. Plus, the Philadelphia Fed's manufacturing index rose to 12 in August from last month's negative 13.5, moving into expansion territory after 11 consecutive months of contraction. Elsewhere, the 10-year Treasury yield surged to its highest level since October 2022.

Continue reading for more on today's market, including:

- Blue-chip retailer posts beat-and-raise.

- Cisco stockmarks 16-month high after earnings.

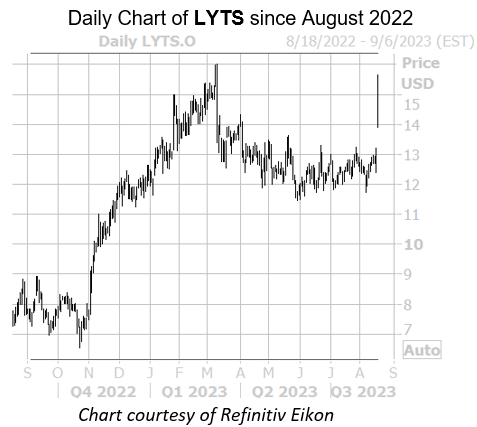

- Plus, options traders eye STNE; LYTS moves toward 15-year highs; and AHCO plummets on CEO lawsuit.

Fintech stock StoneCo Ltd (NASDAQ:STNE) is popular among options traders today, after the company's strong second-quarter results and upbeat current-quarter forecast. So far, 11,000 calls and 9,812 puts have exchanged hands, which is already five times the average intraday volume. The January 2024 12-strike put is the most popular, with positions being opened there. At last glance, STNE was down 6.6% to trade at $12.46, but still boasts a 32.1% year-to-date lead.

LSI Industries Inc (NASDAQ:LYTS) is up 17.2% at $14.95 at last glance, after the company beat fiscal fourth-quarter earnings and revenue expectations. Moving back toward its March 10, 15-year high of $16, the equity is also up 22.2% so far in 2023.

Adapthealth Corp (NASDAQ:AHCO) is down 14.5% to trade at $11.52 at last glance, and on the short sale restricted (SSR) list, after news that incoming CEO Crispin Teufel is getting sued by former employer Linde (LIN). Since the start of the year, AHCO is down 40%.