The Dow and S&P 500 have moved into positive territory

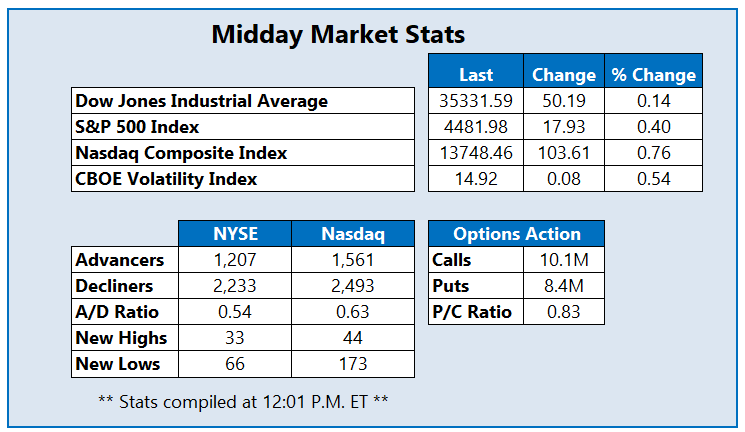

Wall Street is looking to shake off this morning's slump, after a rocky August kickoff. Both the Dow Jones Industrial Average (DJI) and S&P 500 (SPX) are higher at midday, while the Nasdaq Composite (IXIC) is boasting a triple-digit lead. Elsewhere, the Cboe Volatility Index (VIX) could snap a three-day losing streak.

Continue reading for more on today's market, including:

- Retail stock tripped up before earnings.

- Not a whole lot to like about this biotech stock.

- Plus, options bears blast sinking AMC; CLF offer rejected, and copper stock sinks.

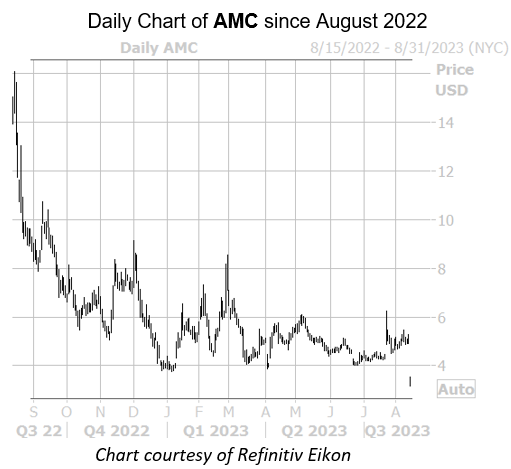

Options traders are blasting AMC Entertainment Holdings Inc (NYSE:AMC), as the stock plummets following the approval of its revised conversion settlement. So far today, 425,000 calls and 944,000 puts have been exchanged, or four times the average daily volume. The August 4 put is the most active contract, followed by the 3 put in that same series. At last check, AMC is down 33.2% at $3.52, and trading at fresh two-year lows.

Mining stock Cleveland-Cliffs Inc (NYSE:CLF) is 8.2% higher to trade at $15.90, after the company offered to buy U.S. Steel (X) for $7.3 billion, though the latter rejected this offer. Fresh off two-straight weeks of losses, CLF is down 20.4% year-over-year.

Freeport-McMoRan Inc (NYSE:FCX) stock is down 1.8% at $40.66 at last check, after the copper giant disclosed a cybersecurity incident impacting its information systems. FCX is already down roughly 10% in August, but is still holding above its year-to-date breakeven level.