Investors are awaiting the release of the Fed's June meeting minutes

Stocks are moving lower ahead of the Federal Reserve's June meeting minutes, which are due out this afternoon and expected to provide clarity on the future of interest rates. In response, the Dow Jones Industrial Average (DJI) and S&P 500 Index (SPX) are both lower, while the Nasdaq Composite (IXIC) is flat. Traders are also unpacking factory orders for May, which rose less than analysts anticipated.

Continue reading for more on today's market, including:

Call traders are blasting Coty Inc (NYSE:COTY) after a price-target hike from BofA Global Research to $14 from $13, with today's overall volume running at 33 times the intraday average. So far, 20,000 calls have exchanged hands, compared to only 848 puts, with the weekly 7/7 12.50-strike call standing out as the most popular contract. Last seen up 0.4% to trade at $12.47, the equity sports a 44.7% year-to-date lead.

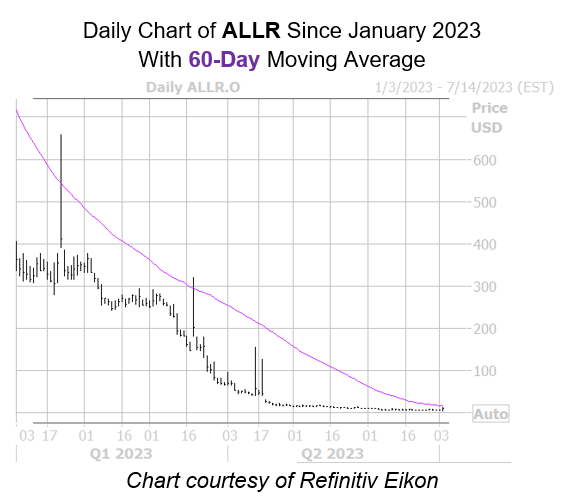

Allarity Therapeutics Inc (NASDAQ:ALLR) is up 91.4% at $12.06 at last check, after phase 2 trial data of its drug showed potential for improved clinical benefit in metastatic breast cancer patients. The equity is still struggling with a long-term ceiling at its 60-day moving average, and is down 96.8% in 2023.

Cassava Sciences Inc (NASDAQ:SAVA) is one of the worst stocks on the Nasdaq, down 14.3% to trade at $21.71 at last glance. The pharmaceutical concern reported its oral simufilam drug slowed cognitive decline by 38% in six months in patients with mild-to-moderate Alzheimer’s disease. The security earlier gapped to a 2023 low of $21.06, and is down 26.8% for the year.