Debt ceiling negotiations are in the spotlight to start the week

Stocks are cautiously higher this afternoon, as Wall Street unpacks ongoing debt ceiling negotiations. Senate Democrats have pressed U.S. President Joe Biden to use the 14th Amendment to raise the debt ceiling, while Treasury Secretary Janet Yellen hinted that the negotiations would be successful and said an unprecedented default would "produce financial chaos."

At last glance, the Dow Jones Industrial Average (DJI) and S&P 500 Index (SPX) are just above breakeven, the former looking to snap a five-day skid, while the Nasdaq Composite Index (IXIC) sports a double-digit midday lead.

Continue reading for more on today's market, including:

- Take note of these two upgrades today.

- Bank stock could shake off sector jitters.

- Plus, SOFI's bear note; C3.ai's preliminary results; and Blue Bird's c-suite shakeup.

Trading near annual lows, SoFi Technologies Inc (NASDAQ:SOFI) has seen 122,000 calls and 56,000 puts cross the tape already today -- triple the intraday average volume. Most popular is the May 5 call, followed by the January 2024 5-strike put. The stock was last seen 9.5% lower at $4.55, after Wedbush downgraded the consumer lending stock to "underperform" on the potential necessity to raise capital in order to support growth. Year-over-year, SOFI is down 32.6%.

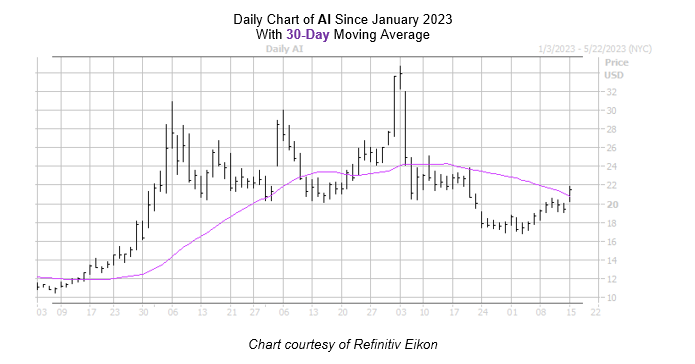

C3.ai Inc (NYSE:AI) is 10.3% higher to trade at $21.41 today, after the artificial intelligence (AI) company released preliminary fourth-quarter revenue that beat analysts' estimates. Though still well below its annual highs, AI is moving above recent pressure at its 30-day moving average, and still sports a 92.6% year-to-date lead.

Blue Bird Corp (NASDAQ:BLBD) is trading near the bottom of the Nasdaq, down 14.9% at $22.40 after the company brought back former CEO Phil Horlock to serve in the same role as well as that of President. The shares still sport an impressive 113.3% year-to-date lead.