The Dow, S&P 500, and Nasdaq secured weekly wins

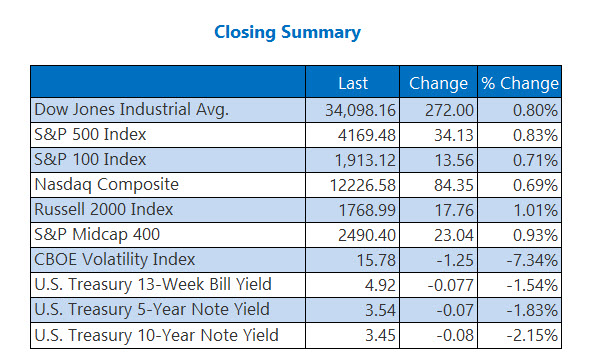

Stocks finished April with a flourish, and now head into a historically bearish period with some momentum. The Dow, S&P 500, and Nasdaq all finished with daily and weekly wins, as earnings reports continue to dominate the headlines on Wall Street.

The blue-chip index and S&P 500 clocked sizable monthly wins -- the former's best since January -- while the Nasdaq finished April marginally in the red. On the way to weekly and monthly losses, Wall Street's "fear gauge," the Cboe Volatility Index (VIX), logged its lowest close since November 2021.

Continue reading for more on today's market, including:

- Not much to like about Snap stock right now.

- How to prepare for stock market volatility.

- Plus, a red-hot Dow stock; AMZN's gloomy day; and unpacking earnings reports.

Things to Know Today

- Good news, potential homebuyers: Pending home sales fell for the first time since November. (MarketWatch)

- Verizon Communications (VZ) is enjoying its best day since February 2021, after last week's steep telecom sector selloff. (MarketWatch)

- McDonald's stock can't be stopped.

- Dismal forecast dings Amazon.com stock.

- Keep track of notable earnings reports this week.

Gold Falls Short of 2K Yet Again

Oil prices climbed today, with June-dated crude adding $2.02, or 2.7%, to close at $76.78 per barrel. For the week, black gold shed 1.4%, but the commodity did finish the month with a 1.5% rise.

Gold prices made another run at $2,000 today, but ultimately fell short. The June-dated commodity added 10 cents, to settle at $1,999.10 an ounce. It gained 0.4% for the week and 0.7% in Apri;.