All three major indexes are lower midday

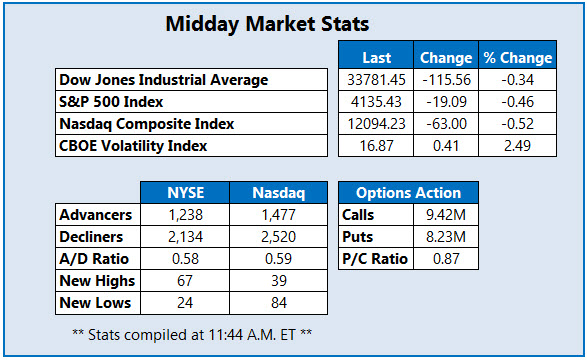

Stocks are lower this afternoon, with the Dow Jones Industrial Average (DJI) headed for its third-straight daily loss. Investors are continuing to unpack earnings from several big names including Tesla (TSLA), which is leading tech stocks lower after its disappointing report. Meanwhile, the Cboe Volatility Index (VIX) is on the rise and looking to snap a six-day losing streak.

Continue reading for more on today's market, including:

- Analysts bet on casino stock after earnings.

- Cannabis stocks to watch on 4/20.

- Plus, options traders target IBM after earnings; NOVA scores government loan; and EGBN gaps lower.

IBM Common Stock (NYSE:IBM) is up 1.8% at $128.57 at last glance, after its first-quarter profit beat and revenue miss. No fewer than four analysts lowered their price targets, and options traders are chiming in at five times the intraday average volume, with 40,000 calls and 26,000 puts exchanged so far. The April 130 call is the most active, followed by the 128 call in the same series. On the charts, IBM's 60-day moving average appears to be keeping gains in check.

Sunnova International Energy Inc (NYSE:NOVA) is up 11.8% at $17.70 at last check, after the U.S. guaranteed $3 billion to the company to help expand clean energy access. The $18 level appears to be keeping a cap on today's gains. Year-to-date, NOVA is still down a slim 1.9%.

Meanwhile, Eagle Bancorp Inc (NASDAQ:EGBN) is down 17.3% at $26.06, after its first-quarter profit miss. The stock is trading at its lowest levels since September 2020, and on track for its 11th-straight weekly loss. Year-to-date, the equity is down 40.6%.