The S&P 500 and Nasdaq are lower at midday

The Dow Jones Industrial Average (DJI) is up 81 points this afternoon, while the S&P 500 Index (SPX) and Nasdaq Composite (IXIC) are lower, with stocks kicking off a new month after a February decline. Rising bond yields are again weighing on sentiment, as traders unpack the ISM manufacturing index, which came in at 47.7% for last month -- still in contraction territory.

- Biotech stock sinks to two-year low.

- Call traders target struggling AMC stock.

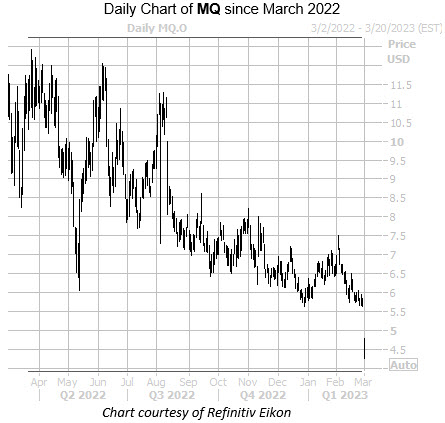

- Plus, MQ sees options surge; RETA soars on FDA approval; and XMTR bottoms out.

Options traders are targeting Marqeta Inc (NASDAQ:MQ) today, with 87,000 calls and 36,000 puts across the tape so far, or 95 times the typical intraday volume. The March 5 call is the most popular, with new positions opening there. The company reported better-than-expected fourth-quarter results, but J.P. Morgan Securities downgraded the equity to "neutral" from "underweight," citing a muted 2023 growth outlook. No fewer than four other analysts cut their price targets as well. MQ is down 20.6% at $4.61 at last check, and earlier hit a fresh record low of $4.27.

Reata Pharmaceuticals Inc (NASDAQ:RETA) stock is up a whopping 169.5% to trade at $84.02 at last glance, and earlier hit a one-year high of $90, after the U.S. Food and Drug Administration (FDA) approved the company's Skyclarys treatment for Friedreich's ataxia, a rare genetic disorder. No fewer than eight analysts lifted their price targets after the news. Year-over-year, RETA is up 153.7%.

The shares of Xometry Inc (NASDAQ:XMTR) are down 41.3% at $17.84 at last check , and dipped to at record low of $17.02 after the software company's wider-than-expected fourth-quarter losses and revenue miss. Year-to-date, the equity is down 45.8%.