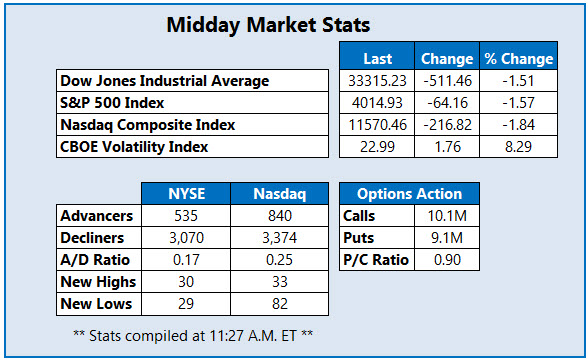

All three major indexes are lower at midday

The Dow Jones Industrial Average (DJI) is down a staggering 511 points as the market extends its morning slide, while both the S&P 500 Index (SPX) and Nasdaq Composite Index (IXIC) are also firmly lower. Investors are keeping an eye on rising bond yields, as well as plenty of retail earnings, including results from Walmart (WMT). Plus, existing home sales hit their lowest level in 12 years.

Continue reading for more on today's market, including:

- Generac stock downgraded on higher interest rates.

- Medical device stock eyes worst single-session drop.

- Plus, HD draws options traders; oil stock surging; and Donnelley Financial shares quarterly miss.

Options bulls are blasting Home Depot Inc (NYSE:HD), after the retailer's mixed fourth-quarter results. So far, 43,000 calls and 37,000 puts have crossed the tape, which is five times the intraday average volume. The weekly 2/24 330-strike call is the most active contract, with positions being opened there. HD was down 5.2% at $301.42 at last check, and breaking below its 100-day moving average.

The New York Stock Exchange's(NYSE) Helix Energy Solutions Group Inc (NYSE:HLX) is up 15.7% to trade at $8.82 at last check, after the company's fourth-quarter report. The oil name reported better-than-expected earnings of 2 cents per share alongside a revenue beat, after which BTIG raised its price target to $12 from $10. Year-over-year, HLX is up 118.8%.

The shares of Donnelley Financial Solutions Inc (NYSE:DFIN) are moving in the opposite direction, after the company's fourth-quarter results missed estimates. At last glance, DFIN was down 21.3% at $39.01. Year-over year-date, however, the security is still up 17.1%.