Jobless claims jumped to a higher-than-expected 196,000

Investors are unpacking the latest batch of corporate earnings reports this morning, which brought quarterly wins from Walt Disney (DIS) and PepsiCo (PEP). Jobless data is also on tap, with weekly claims jumping to a higher-than-anticipated 196,000, sending Treasury yields lower and fueling hopes that the Federal Reserve will continue to back off its hawkish stance.

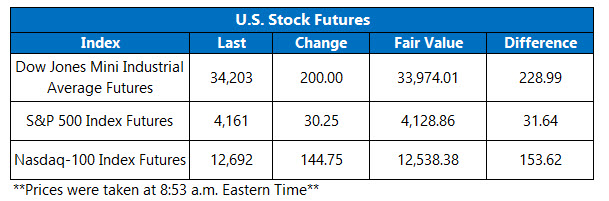

Futures on the Dow Jones Industrial Average (DJIA) and Nasdaq-100 Index (NDX) are pacing for a triple-digit pop, while S&P 500 Index (SPX) futures are also comfortably higher.

Continue reading for more on today's market, including:.

5 Things You Need to Know Today

- The Cboe Options Exchange (CBOE) saw more than 1.3 million call contracts and 805,101 put contracts traded on Wednesday. The single-session equity put/call ratio rose to 0.63 and the 21-day moving average stayed at 0.80.

- Walt Disney Co (NYSE:DIS) is up 6.1% in ahead of the bell, after the company revealed better-than-expected first-quarter earnings and revenue, thanks in part to a return to its theme parks. The media giant also announced it will be laying off 7,000 workers as it looks to reduce costs and make its streaming business profitable. Year-over-year, DIS is down 21.5%.

-

MGM Resorts International (NYSE:MGM) beat revenue expectations for the fourth quarter, despite worse-than-anticipated losses. The

casino operator also plans to scrap a buyout by gambling firm Entain. At least seven analysts have lifted their price objectives, sending the shares 6.4% higher before the open. Year-to-date, MGM has already added 23.6%.

-

The shares of

Tesla Inc (NASDAQ: TSLA) are up 3.2% in premarket trading, after a U.S. prone found no evidence of autopilot use during an April 2021 fatal crash of a Tesla Model S. Plus, CEO Elon Musk announced plans to reveal his

“Master Plan 3.” TSLA has shed 34.5% over the last 12 months.

-

No relevant indicators are on tap today.

European Markets React to Stateside Fed Comments

Asian markets settled on both sides of the aisle Thursday, as investors consider future rate hikes globally. Hong Kong’s Hang Seng led the winners with a 1.6% gain, as several casino stocks enjoying a post-earnings boost. China’s Shanghai Composite followed behind with a 1.2% win, while the South Korean Kospi and Nikkei in Japan fell 0.09% and 0.08%, respectively.

Over in Europe, shareholders are also unpacking the latest Fed comments stateside. The bourses are all higher at midday, with London’s FTSE 100 sporting a 0.7% lead, while the French CAC 40 and German DAX both jump 1.2%.