Private payrolls rose by less than Wall Street anticipated

Stock futures are pointed lower this morning, as traders brace for today's interest rate decision, which will be followed by comments from Federal Reserve Chairman Jerome Powell. The Dow Jones Industrial Average (DJIA) is bearing the brunt of premarket losses, last seen down 147 points. Wall Street is unpacking the ADP employment report, which showed private payrolls rose by 106,000 in January as opposed to the expected 190,000.

Continue reading for more on today's market, including:

5 Things You Need to Know Today

- The Cboe Options Exchange (CBOE) saw more than 1.2 million call contracts and 822,034 contracts traded on Tuesday. The single-session equity put/call ratio rose to 0.66 and the 21-day moving average stayed at 0.81.

-

Online dating name

Match Group Inc (NASDAQ:MTCH) is down 9.2% before the bell, after the

Tinder parent posted a fourth-quarter earnings and revenue miss, and shared a disappointing current-quarter revenue forecast. Year-over-year, MTCH is down 52%.

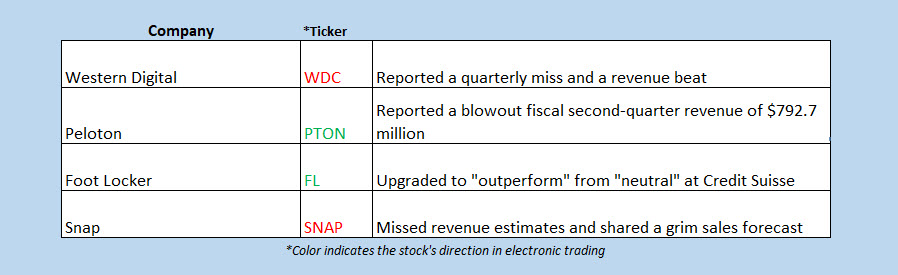

- Snap Inc (NYSE:SNAP) is also sharply lower, last seen down 14.9% ahead of the open. While the social media giant's fourth-quarter revenue was in line with estimates, it projected current-quarter revenue to decline up to 10% amid weak advertising demand. The security has attracted at least six price-target cuts already, and has shed 64.5% in the last 12 months.

- The shares of Advanced Micro Devices, Inc. (NASDAQ:AMD) are up 2.9% in electronic trading, following the chipmaker's better-than-expected fourth-quarter results. No fewer than five analysts hiked their price targets in response. Over the last three months, AMD added 26%.

- Today will bring job openings and quits, the S&P manufacturing purchasing managers' index (PMI), the Institute for Supply Management (ISM) manufacturing index, construction spending data, motor vehicle sales, and both the Federal funds rate and projection.

Asian, European Markets Higher on Slew of Economic Data

Markets in Asia rose on Wednesday, as investors unpacked a host of economic data from the region while looking forward to the conclusion of the Fed meeting stateside. Japan’s Nikkei inched 0.07% higher, even after the country’s factory activity contracted for the third consecutive month in January. China’s manufacturing purchasing managers’ index (PMI) for January came in at a lower-than-expected 49.2, which is slightly higher than December’s reading of 49. In South Korea, export numbers fell 16.6% year-over-year, and the country’s 2022 trade deficit of $47.5 billion marked its worst recorded reading. China’s Shanghai Composite rose 0.9%, while Hong Kong’s Hang Seng and the South Korean Kospi added 1.1% and 1%, respectively.

European markets are higher at midday, while the bourses await interest rate decisions from the U.S., Bank of England (BoE), and European Central Bank (ECB) this week. Preliminary data out today showed inflation in the euro zone came in at 8.5% in January, down from the previous month’s 9.2%, as energy costs continue their sharp drop. London’s FTSE 100 and the French CAC 40 are both up 0.2% at last glance, while the German DAX sits with a 0.3% lead.