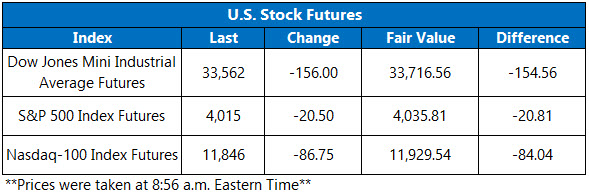

All three major benchmarks are lower premarket

Following two straight days of gains on Wall Street, futures on the Dow Jones Industrial Average (DJIA) are down triple digits ahead of the open, while Nasdaq-100 Index (NDX) and S&P 500 Index (SPX) futures swim in red ink as well. Investors are eyeing this week's busy earnings docket, with a host of economic data due at the end of the week.

Continue reading for more on today's market, including:

- Schaeffer's Senior V.P. of Research Todd Salamone shares the good and bad news encompassing the S&P 500 right now.

- Chevron stock has room to run.

- Plus, LULU drops on downgrade; LMT reports earnings; and analyst praises LYFT.

5 Things You Need to Know Today

- The Cboe Options Exchange (CBOE) saw more than 1.8 million call contracts and over 1 million put contracts traded on Monday. The single-session equity put/call ratio fell to 0.53 and the 21-day moving average stayed at 0.81.

-

Lululemon Athletica Inc (NASDAQ:LULU) is down 2.4% premarket, after Bernstein downgraded the stock to "underperform" from "market perform," with a price-target cut to $290 from $340. The firm warned of a "reset" on the way for the retailer. Should these losses hold, LULU will dip back below its year-over-year breakeven level.

- Lockheed Martin Corp (NYSE:LMT) is up 1.7% before the bell. The company's fourth-quarter results beat expectations, however, its profit forecast disappointed amid lingering supply issues and costs. Year-over-year, the equity is up 18.9%.

- Lyft Inc (NASDAQ:LYFT) is up 4.5% in electronic trading, after Keybanc upgraded the shares to "overweight" from "sector weight." The analyst in coverage sees an over 50% potential upside for LYFT as demand stabilizes, citing company layoffs as well. The rideshare name is already up 39.8% since the start of 2023.

- Today will bring the S&P U.S. manufacturing and services PMIs.

Investors Unpack Inflation Data Overseas

While the majority of Asian bourses were closed to celebrate the Lunar New Year Holiday, Japan’s Nikkei added 1.5% on Tuesday. The au Jibun Bank Flash Japan manufacturing purchasing managers’ index (PMI) came in flat for the second-straight month, the yen strengthened against the greenback, and the 10-year Japanese Government Bond yield held the area just under the central bank’s upper rung of its tolerance range.

The euro zone’s s latest PMI data is weighing on the region today. While the S&P Global composite PMI checked in at 50.2 for January, legging out forecasts of 49.8, the U.K. flash PMI showed services and manufacturing fell to 47.8 this month – the sharpest contraction rate in two years. At last check, London’s FTSE 100 and Germany’s DAX are 0.3% lower, while France’s CAC 40 is fractionally higher.