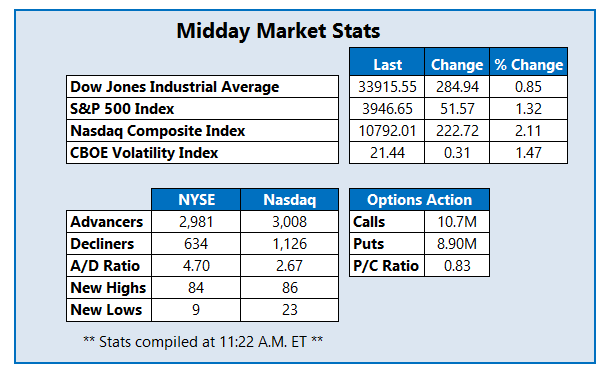

The Dow and Nasdaq are up triple digits midday

Stocks are staying hot to start the week, taking their cues from Friday's rally. The Dow Jones Industrial Average (DJI) is up more than 280 points midday, while the Nasdaq Composite Index (IXIC) is also up triple digits. The S&P 500 Index (SPX) is well into the black as well, after energy stocks and oil prices injected optimism on Wall Street.

The Federal Reserve's monthly Survey of Consumer Expectations for December showed the one-year inflation outlook fell by 5%, indicating consumers see the burden of inflation easing.

Continue reading for more on today's market, including:

- What higher car prices mean for Uber stock.

- Pharma company announces cost saving measures.

- Plus, RKT calls pop despite bear note; AstraZeneca's newest acquisition; and a medtech stock at new lows.

Despite a downgrade to "underperform" from Credit Suisse, Rocket Companies Inc (NYSE:RKT) is seeing an surge in call activity today. So far today, more than 23,000 calls have been exchanged, volume that's 15 times the intraday average volume. New positions are being opened at the weekly 1/13 8-strike call, the January 8-strike call, and the 8.5-strike call from the 1/13 series. At last glance, RKT is 3.1% higher to trade at $7.72, but sports a 41.1% year-over-year deficit.

AstraZeneca (AZN) is set to acquire CinCor Pharma Inc (NASDAW:CINC) for $1.8 billion, helping the latter's shares add 136.5% this afternoon to trade at $27.8 -- the best performance on the Nasdaq so far today. This massive bull gap on the charts puts CINC at its highest level since November, though the stock is still well below its Aug. 8, all-time high of $43.15. Year-over-year, CinCor Pharma stock is now 74.6% higher.

Following the release of certain preliminary, unaudited financial results for 2022,

Cutera, Inc. (NASDAQ:CUTR) is trading at the bottom of the Nasdaq. Last seen down 25.9% to trade at $29.96, the medtech stock is trading at its lowest level since May 2021. The company lowered its full-year 2022 revenue guidance after shedding more than 51% over the last nine months.