All three major benchmarks are lower at midday

Stocks are extending their losses this afternoon, after the latest weekly jobless data failed to keep tailwinds blowing on Wall Street. Recession fears are back on the table, as traders continue to mull over hawkish stances from central banks across the world. The Dow Jones Industrial Average (DJI) is down more than 530 points, while the S&P 500 Index (SPX) and Nasdaq Composite Index (IXIC) are sharply lower as well.

Continue reading for more on today's market, including:

- Options bears are blasting this chip stock.

- 2 biotechs making headlines.

- Plus, KMX options running red-hot; why CLF is surging; and AMC hits a fresh low.

CarMax, Inc (NYSE:KMX) is getting blasted in the options pits today, with 46,000 puts and 11,000 calls across the tape thus far, or 17 times the volume that's typically seen at this point. Most popular are the weekly 12/23 50- and 54-strike puts, with new positions being opened at both. Last seen down 7.8% at $54.73, the used car retailer reported a third-quarter earnings and revenue miss, and also paused its share buyback program. The security dropped to a fresh two-year low of $52.10 earlier, and is now eyeing its worst single-day percentage drop since September. KMX has shed 58.1% in 2022. Unsurprisingly, KMX is sitting comfortably on the short sale restricted (SSR) list as well.

One of the best stocks on the New York Stock Exchange (NYSE) today is

Cleveland-Cliffs Inc (NYSE:CLF). The security is up 9.2% at $16.52 at last check, after the steel producer noted it expects higher annual fixed prices in 2023, with a large portion of its contracts

already renewed. CLF is today trading at its highest level since September, though a long-term ceiling at the $17 appears to be capping those gains. Quarter-to-date, the equity has added 23.2%.

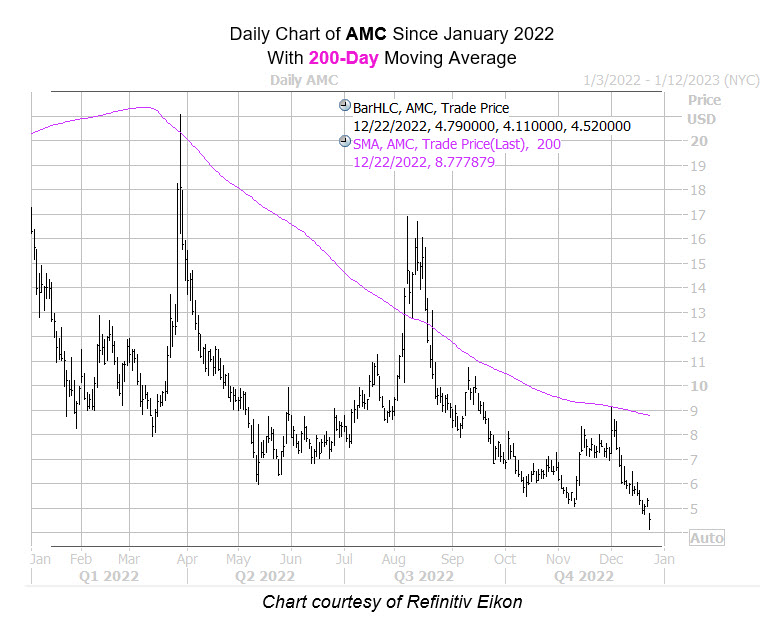

AMC Entertainment Holdings Inc (NYSE:AMC) is pacing towards the bottom of the NYSE, however, last seen down 13.1% to trade at $4.61. The shares also hit a more than one-year low of $4.11 after the movie theater name proposed a reverse stock split and said it would raise $110 million in new equity capital through a preferred stock sale. AMC lost support at its 20-day moving average earlier this month, and carries a 72.9% year-to-date deficit.