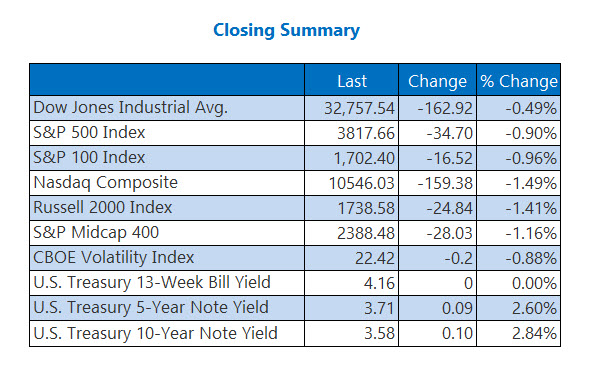

The Dow finished the day 162 points lower

In what seems like a pattern this month, stocks reversed their modest gains from the morning to finish lower. The Dow finished 162 points lower, while the S&P 500 and Nasdaq finished deep in the red as well, with all three benchmarks securing their fourth-straight losses. Yet again though, Wall Street's "fear gauge" -- the Cboe Volatility Index (VIX) -- fell lower, logging its second-straight drop.

Continue reading for more on today's market, including:

- Options bears eye CarMax stock ahead of earnings.

- Pharmaceutical stock soars on trial data.

- Plus, WMG's bull notes; MESA switches airlines; and TSLA's Twitter troubles.

5 Things to Know Today

- Ukraine was the subject of a drone attack by Russia on Monday, in what was described as one of the "biggest assaults on Kyiv" since the war started. (MarketWatch)

- Epic Games, the creator of "Fortnite," will pay $520 million to settle allegations of privacy violations. (Reuters)

- Analysts praise Warner Music Group stock.

- The penny stock surging after airline switch.

- TSLA is in the spotlight amid the latest Twitter drama.

There were no earnings of note today.

Oil Prices Continue Rise

Oil prices rose following last week's nearly 5% gain. West Texas Intermediate (WTI) crude for January delivery added $1.18, or 1.6%, to settle at $75.47 a barrel.

Fresh off a weekly loss, gold prices finished lower for the day. February-dated gold fell $2.50, or 0.1%, to settle at $1,787.70 per ounce.