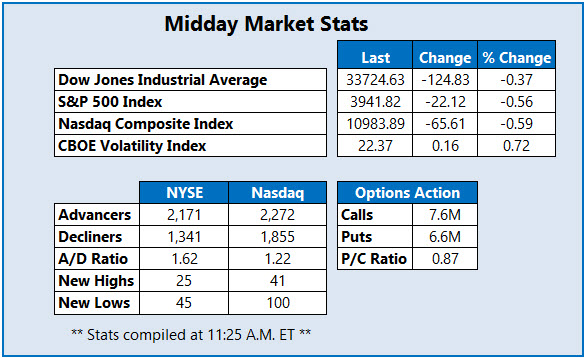

The Dow is down 124 points midday

It's been a volatile day of trading following yesterday's selloff, with stocks currently swimming in red ink at midday. China-based stocks are getting some relief, as the negative sentiment that permeated the market yesterday over the country's lockdowns appears to have shifted, giving oil prices a boost as well.

Meanwhile, investors are unpacking plenty of economic data stateside. The S&P Case-Shiller U.S. home price index fell 1.2% in September for its third-straight monthly decline, roughly matching analyst estimates of a 1.2% decrease. A survey of consumer confidence also fell to 100.2 in November -- its lowest level in four months.

Continue reading for more on today's market, including:

- The new partnership giving Nio stock a boost.

- British bank stock on the rise after billion-dollar deal.

- Plus, options bulls blast GRWG; and two stocks moving opposite ways after earnings.

GrowGeneration Corp (NASDAQ:GRWG) is seeing a bullish options surge today, with 17,000 calls exchanged so far, which is nine times the intraday average. The weekly 12/2 6.50-strike call is the most popular, with new positions being opened. GRWG is up 12.2% at $6.24 at last check, though the reason for today's surge is unclear.

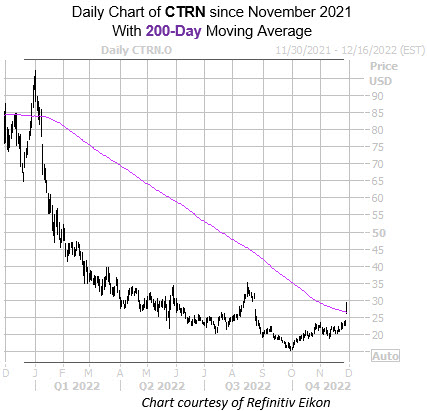

Citi Trends Inc (NASDAQ:CTRN) is one of the top performers on the Nasdaq today, up 23.1% at $28.56 at last glance, after the retailer's third-quarter results beat. The stock has been steadily rising since its September lows, and is today looking to close above its 200-day moving average for the first time since January. Year-to-date, the equity is down roughly 70%.

Conversely, Israel's Elbit Systems Inc (NASDAQ:ESLT) is slipping after its third-quarter results missed estimates. Down 9.9% at $168.22 at last check, the stock is trading at its lowest levels since February. Year-to-date, ESLT is sporting a 3.4% loss.