The Dow notched another triple-digit pop

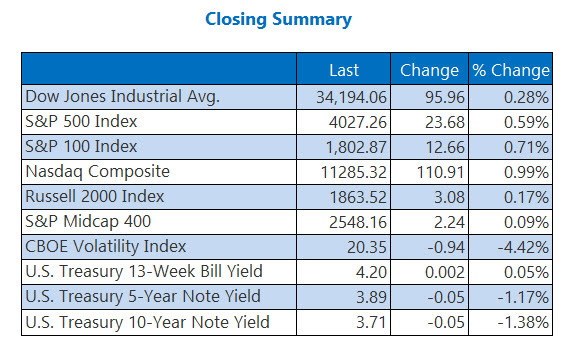

Stocks took home another win on Wednesday, as investors gear up for tomorrow's market closure due to the Thanksgiving holiday. Markets will resume activity on Friday, with an early 1p.m. ET closure. The Dow settled the day with a near 96-point pop, while the S&P 500 and Nasdaq notched comfortable gains of their own. The Fed's November meeting minutes had traders cheering, after the central bank signaled that it's seeing some progress in its attempts to beat back inflation, and foresees smaller rate hikes through the ends of 2022. Meanwhile, Treasury yields continue to fall, with the 10-year dropping to 3.717%

Continue reading for more on today's market, including:

- Why options traders, analysts chimed in on Autodesk.

- This retailer just slashed its full-year profit outlook.

- Plus, DE nabs record high; MANU's potential sale; and HP layoff news.

The Dow Jones Industrial Average (DJI - 34,194.06) gained nearly 96 points, or 0.3% for the day. Walt Disney (DIS) paced the gainers with a 2.8% win. Amgen (AMGN) led the laggards with a 1.3% loss.

The S&P 500 Index (SPX - 4,027.26) added 23.7 points, or 0.6% for the day, while the Nasdaq Composite Index (IXIC - 11,285.32) added 110.9 points, or 1%.

Lastly, the Cboe Volatility Index (VIX - 20.35) shed 0.9 point, or 4.4% for the session.

5 Things to Know Today

- A letter FTX's ex-CEO Sam Bankman-Fried sent to employees blamed "irrational decisions" for his actions. (CNBC)

- Author Stephen King has put in his two cents about Elon Musk's Twitter takeover in a biting tweet yesterday. (MarketWatch)

- Deere stock hit a record high after its earnings report.

- Everything you should know about Manchester United's potential sale.

- How investors reacted to HP's long-term layoff update.

Due to technical difficulties the Unusual Options Volume chart is unavailable today

Group of Seven Meet Over Russian Oil's Price Cap

Oil prices took a step back amid talks between the Group of Seven (G-7) regarding price caps on Russian oil, which could range anywhere from $60 to $70. The now front-month, January-dated crude shed $3.01 cents, or 3.7%, to trade at $77.94 per barrel.

Gold prices rose, settling higher ahead of the release of today's Fed meeting minutes as investors digested a slew of economic data, including a rise in new home sales and durable goods orders. December-dated gold added $5.70 or roughly 0.3%, to settle at $1,745.60 an ounce.