Investors are hoping that rising inflation and Fed interest rate hikes could ease by year's end

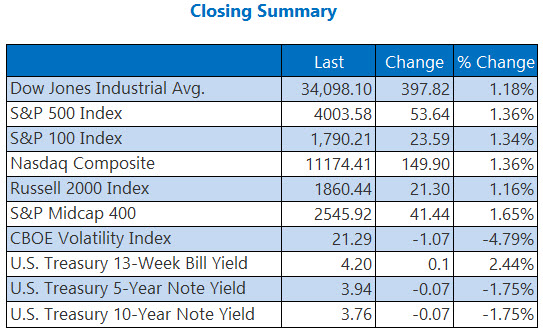

Sentiment turned around on Tuesday, as investors speculated on slowing inflation and a softer approach from the Federal Reserve towards the year's end. The Dow rose 397 points, while the Nasdaq also saw a triple-digit pop, and the S&P 500 bagged a comfortable win of its own. Retail saw an upbeat day after several big names including Best Buy (BBY) and American Eagle Outfitters (AEO) surged after earnings. Bond yields, meanwhile, receded amid the optimism, with the 10-year Treasury yield falling back to 3.76%.

Continue reading for more on today's market, including:

- Why Etsy stock might be a smart pre-holiday buy.

- This insurance stock could see even more record highs.

- Plus, energy stock to watch; DLRT's earnings beat; and ZM lowers full-year forecast.

The Dow Jones Industrial Average (DJI - 34,098.10) gains 397.8 points, or 1.2% for the day. Salesforce (CRM) paced the gainers with a 3% win. Walt Disney (DIS) led the laggards with a 1.4% loss.

The S&P 500 Index (SPX - 4,003.58) added 53.6 points, or 1.4% for the day, while the Nasdaq Composite Index (IXIC - 11,174.41) fell 149.9 points, or 1.4%.

Lastly, the Cboe Volatility Index (VIX - 21.29) shed 1.1 point, or 4.8% for the session.

5 Things to Know Today

- The Supreme Court will hear Jack Daniel's trademark case against VIP Products concerning their "Bad Spaniels" whiskey bottle-shaped squeak toy. (CNBC)

- Budweiser said it will take some of the beer it planned to sell during the World Cup tournament in Qatar, which wound up banning alcohol sales in stadiums, and give it to the nation that wins the tournament. (MarketWatch)

- This energy stock's rally could have legs.

- How options traders reacted to Dollar Tree's beat-and-raise.

- Zoom Video Communications cuts full-year forecast.

Due to technical difficulties the Unusual Options Volume chart is unavailable today

Gold Barely Snaps 4-Day Losing Streak

Investors were able to brush off this week's news that the Organization of the Petroleum Exporting Countries (OPEC), including Saudi Arabia, may start increasing oil production soon, sending the liquid gold higher. December-dated crude rose 91 cents, or 1.14%, loss to trade at $80.95 per barrel.

Gold just eked out a win to snap a four-session losing streak as the U.S. dollar's rebound began to slow. December-dated gold added 30 cents or roughly 0.02%, to settle at $1,739.90 an ounce.