The S&P 500 and Nasdaq logged weekly losses

Stocks closed out the week on an uneven note. While the Dow and S&P 500 secured modest wins, the Nasdaq fell into the red by midday and finished lower. The S&P 500 and Nasdaq logged weekly losses, while the Dow finished the week flat, as investors see-saw between panic and optimism over the current state of inflation and the next move from the Federal Reserve. Amid this choppiness, Wall Street's "fear gauge," the Cboe Volatility Index (VIX) logged its first weekly win since Oct. 14.

Continue reading for more on today's market, including:

- This cybersecurity stock got a much-needed win

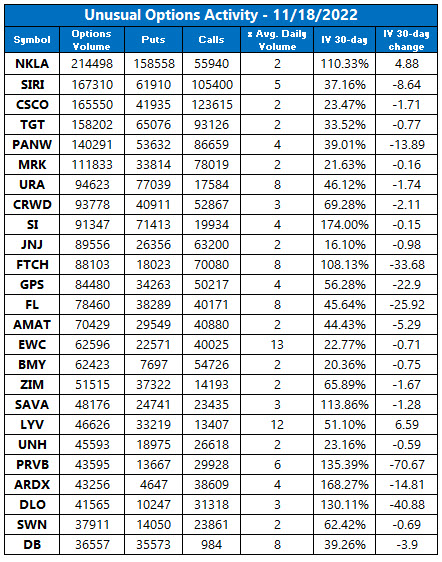

- What options activity can tell us about Tesla stock.

- Plus, Foot Locker's big day; a vaccine stock in focus; and the best stocks to own next week.

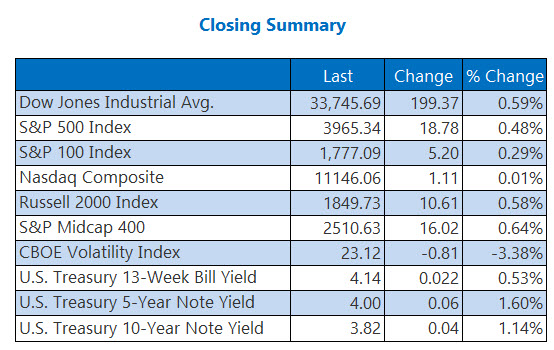

The Dow Jones Industrial Average (DJI - 33,745.69) added 199.4 points, or 0.6% for the day. UnitedHealth (UNH) paced the gainers with a 2.9% win. Salesforce (CRM) led the laggards with a 1.1% loss. The blue-chip index ended the week flat.

The S&P 500 Index (SPX - 3,965.34) tacked on 18.8 points, or 0.5% for the day, while the Nasdaq Composite Index (IXIC - 11,146.06) added 1.1 points. The SPX finished with a 0.7% weekly loss, while the Nasdaq shed 1.6% on the week.

Lastly, the Cboe Volatility Index (VIX - 23.12) shed 0.8 point, or 3.4% for the session. it gained 2.7% on the week.

5 Things to Know Today

- The 2022 FIFA World Cup is off to a rip-roaring start; Qatar has banned the sale of alcohol at stadiums. (CNN)

- At the G-7 summit this week, countries are set to announce a price-cap on Russian crude oil. (Bloomberg)

- Foot Locker stock is eyeing its best day in months.

- Put traders can't get enough of this vaccine stock.

- In case you missed it: target these stocks next week.

Oil, Gold Prices Inch Lower

Oil prices plummeted today, settling at their lowest close since late September as sentiment over inflation, Covid-19 cases in China, and a looming recession worsens. December-dated crude lost $1.56, or 1.9% to trade at $80.08 per barrel.

Gold prices also dropped lower after this morning's hawkish Fed comments strengthened the dollar. December-dated gold lost $8.60 or roughly 0.5%, to settle at $1,754.40 an ounce -- a weekly closing low.