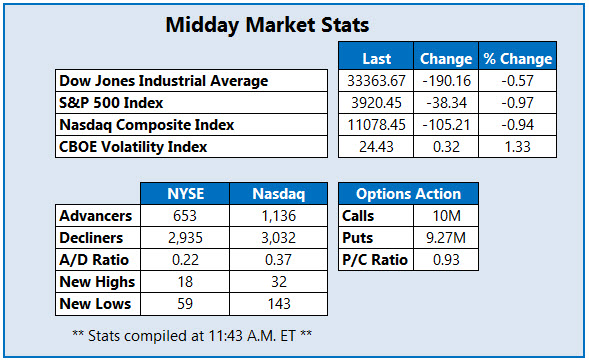

All three major benchmarks are firmly in red ink

Stocks are firmly lower midday, as bond yields rise following hawkish comments from St. Louis Federal Reserve President James Bullard. The Dow Jones Industrial Average (DJI) and Nasdaq Composite Index (IXIC) are both down triple digits, while the S&P 500 Index (SPX) sits firmly lower as well.

The Philadelphia Fed Manufacturing Index for November dropped to negative 19.4 from the previous month's negative 8.7, its lowest level since May 2020 and well below analyst expectations of negative 6. Meanwhile, gold prices are headed towards their lowest close in a week.

Continue reading for more on today's market, including:

Ardelyx Inc (NASDAQ:ARDX) is seeing a surge in options activity today, as the stock skyrockets after the U.S. Food & Drug Administration (FDA) backed its kidney disease drug. So far, 29,000 calls and 8,881 puts have crossed the tape, with overall volume running at 13 times the intraday average. The November 2 call is the most popular, followed by the December 2 call, with new positions being sold-to-open at the latter. At last glance, ARDX was up 29.5% at $1.58. The stock has been firmly in penny stock territory since its July 2021 bear gap.

Bath & Body Works Inc (NYSE:BBWI) is climbing on the New York Stock Exchange (NYSE) today, up 17.6% at $36.62, after the company raised its full-year profit forecast following better-than-expected third-quarter results. In response, BofA Global Research upped its price target by $2 to $50, while Wells Fargo raised its own by $5 to $55. The 180-day moving average appears to be keeping a lid on today's gains. Year-to-date, the equity is still down 46.8%.

Meanwhile, America's Car-Mart Inc (NASDAQ:CRMT) is down 13.1% at $57.02 at last glance, after the company's fiscal second-quarter earnings miss. Now trading at its lowest level since April of 2020, the equity is down 44% year-to-date. It's also worth noting that the stock has landed on the short sell restricted (SSR) list today amid the slide.