The Dow shed 39 points on Wednesday

Wall Street all over the place on Wednesday, with the Dow spending most of the day with shallow losses before settling 39 points lower. The S&P 500, meanwhile, logged a notable drop after Target's (TGT) quarterly results put a damper on recent sentiment. The Nasdaq also plummeted, shedding triple digits and erasing yesterday's win.

The Fed's next move is still very much in focus, with the CME FedWatch tool showing an 85.4% chance of a 50-basis point rate hike for the December backdrop. Elsewhere, the 10-year Treasury yield continues to cool off, last seen below 3.7% and still inverted from the 2-year Treasury yield.

Continue reading for more on today's market, including:

- Micron's supply cut news rocked the chip sector.

- How subscribers doubled their money on DocuSign stock.

- Plus, two downgraded stocks; U.S. gains audits to Chinese companies; and AAP's post-earnings plummet.

The Dow Jones Industrial Average (DJI - 33,553.83) lost 39.1 points, or 0.1% for the day. McDonald's (MCD) led the Dow with a 1.7% win, while Salesforce (CRM) paced the laggards with a 4.3% drop.

The S&P 500 Index (SPX - 3,958.79) lost 32.9 points, or 0.8% for the day, while the Nasdaq Composite Index (IXIC - 11,183.66) lost 174.8 points, or 1.5%.

Lastly, the Cboe Volatility Index (VIX - 24.11) shed 0.4 point, or 1.8% for the session.

5 Things to Know Today

- The House Financial Services Committee is planning a hearing in December focused on "the collapse of FTX and the broader consequences for the digital asset ecosystem." (MarketWatch)

- Binance CEO Changoeng Zhao is establishing a recovery fund to help people in the crypto industry, adding that the sector "will be fine." (CNBC)

- Analysts are wary of these two stocks right now.

- U.S.-listed Chinese stocks were making moves today.

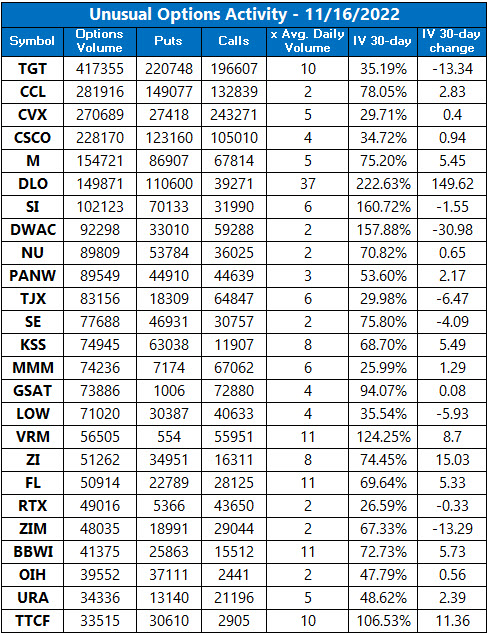

- How options traders reacted to Advance Auto Parts' dismal earnings report.

Oil, Gold Prices Inch Lower

Oil prices settled at their lowest level in roughly three weeks as investors weigh waning demand in China against rising geopolitical tensions. December-dated crude lost $1.33, or 1.5% to trade at $86.59 per barrel.

Gold prices dropped again on Wednesday amid Fed uncertainty. The precious metal is cooling from its recent rebound, and today December-dated gold lost $1 or roughly 0.1%, to settle at $1,775.80 an ounce.