The major indexes are lower at midday

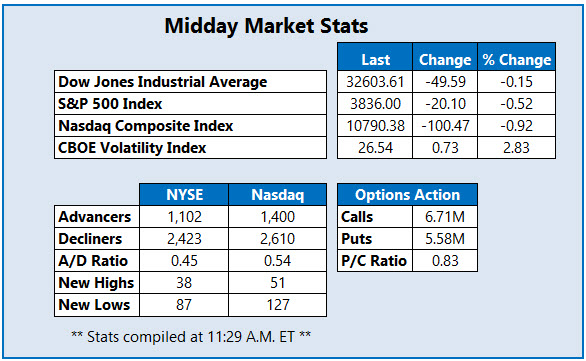

Stocks are lower midday, as Wall Street prepares for the conclusion of the U.S. Federal Reserve's policy meeting, in which a 0.75 percentage point rate increase is expected. The Nasdaq Composite (IXIC) is down triple digits, while the Dow Jones Industrial Average (DJI) and S&P 500 Index (SPX) are more modestly in the red. Meanwhile, today's ADP employment data is solidifying the labor market's strength, following yesterday's strong job openings data.

Continue reading for more on today's market, including:

Airbnb Inc (NASDAQ:ABNB) is seeing a surge of volume in the options pits today. Despite upbeat third-quarter results, the stock's lowered current-quarter forecast is weighing on the shares, and ABNB is down 9% at $99.20 at last look. So far, 72,000 calls and 74,000 puts have crossed the tape. The weekly 11/4 115-strike call is the most active, with new positions being opened there. Analysts are chiming in as well, with no fewer than nine price-target cuts after the event. On the charts, ABNB's 150-day moving average has been keeping a lid on rallies.

Benefitfocus Inc (NASDAQ:BNFT) is at the top of the Nasdaq today, up 47.7% at $10.32 at last glance, following news that Voya Financial (VOYA) will buy the company for an all-cash deal valued at roughly $570 million, or $10.50 per share. In response, Piper Sandler raised its price target to $10.50 from $6. Year-to-date, the equity is still currently down 3.1%.

Conversely, Rogers Corp (NASDAQ:ROG) is at the bottom of the Nasdaq after a scrapped buyout deal. DuPont De Nemours Inc (DD) pulled out of its $5.2 billion buyout of the semiconductor name, citing regulatory hurdles in China. ROG is down 44.6% at $127.01 at last check, and sports a 53.3% year-to-date deficit.