GDP data is boosting sentiment on Wall Street

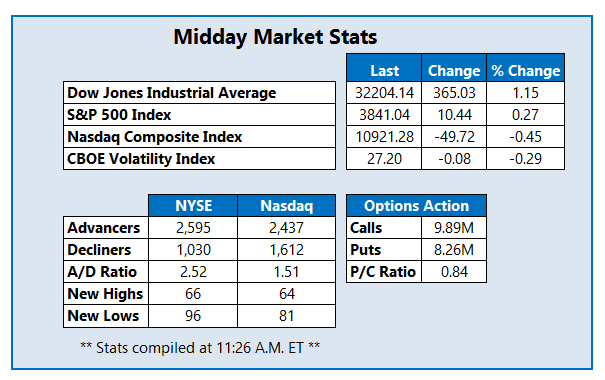

The latest gross domestic product (GDP) report is boosting sentiment slightly on Wall Street this afternoon, helping the Dow Jones Industrial Average (DJI) add more than 360 points on its way to a fifth-straight win. Elsewhere, the S&P 500 Index (SPX) is seesawing between gains and losses, while the Nasdaq Composite Index (IXIC) is solidly lower following a disappointing round of tech earnings, including one from Facebook parent, Meta (META).

Continue reading for more on today's market, including:

- More on Meta Platform's quarterly results.

- Blue-chip stock heading for best month in 13 years.

- Plus, Boeing stock sees post-earnings options surge; and 2 other noteworthy quarterly reports.

Options traders are targeting Boeing Co (NYSE:BA), after Goldman Sachs said the aerospace concern can soar more than 80% following lackluster third-quarter results. Despite the financial giant's praise, Boeing stock has attracted no less than four post-earnings price-target cuts. Nevertheless, the equity was last seen 5.7% higher at $141.52 this afternoon, and more than 56,000 calls and 29,000 puts have been traded so far today -- three times the average intraday volume. New positions are opening at the most popular contract, the weekly 10/28 138-strike call. On the charts, BA is trading back above its 30-day moving average, after a brief dip below the finicky trendline. Year-to-date, the security is 29.2% lower.

Last seen trading 18.4% higher at $34.44, Shopify Inc (NYSE:SHOP) stands as one of the best three equities trading on the New York Stock Exchange (NYSE) this afternoon. This price action comes after the company reported top- and bottom-line beats for the third quarter. Still, Shopify stock remains more than 75% lower on a year-over-year and year-to-date basis.

Near the bottom of the Nasdaq this afternoon sits Align Technology, Inc. (NASDAQ:ALGN). Shares of the Invisalign maker were last seen 17.3% lower to trade at $182.94, following a third-quarter earnings and revenue miss. ALGN is now trading at its lowest point since the broader-market's 2020 pullback, putting it at a 72.4% year-to-date deficit.