The major indexes are extending this morning's gains

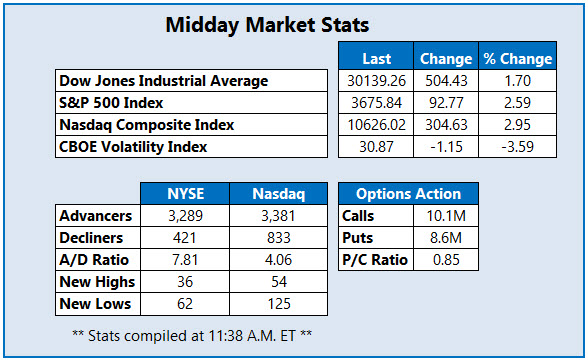

Stocks are starting the week off strong, extending this morning's gains at midday. The Dow Jones Industrial Average (DJI) is up 504 points at last glance, with help from surging Microsoft (MSFT) stock, and looking to recover from Friday's selloff that sent it below the psychologically significant 30,000 level. Earnings season is rolling in, with reports from several bank names for investors to unpack. Meanwhile, the Empire State manufacturing index fell for the third-straight month, dropping to -9.1, compared to expectations of -5.

Continue reading for more on today's market, including:

- Biotech stock hit with yet another bear note.

- Bank of America posts upbeat quarterly results.

- Plus, NOK puts pop; LFG soars on buyout; and NGM plummets into penny stock territory.

Nokia Oyj (NYSE:NOK) put options are flying off the shelves today. So far, 17,000 puts have been exchanged -- 21 times the intraday average -- in comparison to 8,054 calls. The most popular contract is the October 4.50 put, expiring at the end of this week. The stock is receiving attention today, after news that it will build a new research and development (R&D) hub in Ottawa, ON. At last glance, NOK was up 3.4% to trade at $4.60, climbing further from its Sep. 27, 18-month low of $4.19, with long-term pressure looming above at the 180-day moving average.

Near the top of the New York Stock Exchange (NYSE) this afternoon Archaea Energy Inc (NYSE:LFG), last seen up 52.4% to trade at $25.73, and earlier hit a record high of $25.96. Today's pop comes after news that BP (BP) is buying the renewable energy company for $26 per share in cash -- a value of $4.1 billion.

Meanwhile, NGM Biopharmaceuticals Inc (NASDAQ:NGM) is at the bottom of the Nasdaq, down 72.9% at $3.13 and plummeting into penny stock territory from last session's close at $11.55. Weighing on the shares today is news that the company's eye disease drug, NGM621, failed in a mid-stage trial. Now trading at record lows, NGM is down 82.3%.