The major indexes are on track to snap a three-week losing streak

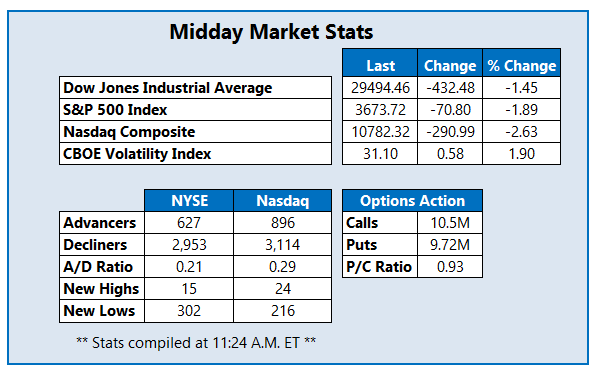

Stocks are falling to close out the week, as September's jobs report showed the economy added less jobs that anticipated alongside a lower-than-expected unemployment rate. At last glance, the Dow Jones Industrial Average (DJI) is down more than 400 points, while the S&P 500 Index (SPX) is deep in the red, and the Nasdaq Composite (IXIC) sports a triple-digit loss. The major benchmarks are, however, each headed for weekly gains, on par to snap a three-week losing streak.

Continue reading for more on today's market, including:

- Another bear note hints at who's winning the rideshare battle.

- Semiconductor giant lowers third-quarter sales forecast.

- Plus, Tilray's post-earnings options buzz; finance name settles billion-dollar litigation; and Roblox faces a lawsuit.

Tilray Inc (NASDAQ:TLRY) is seeing tons of post-earnings options interest today. The cannabis concern is down 8% to trade at $3.59, after reporting a losses and revenue that were wide of Wall Street's estimates, though the company reaffirmed its full-year forecast after saying it achieved most of its cost-saving goal. At the midday mark, more than 167,000 calls and 72,000 have crossed the tape, which is 16 times the average intraday amount. The most popular position is the weekly 10/7 4-strike call, where new positions are being opened.

Tilray stock's descending 140-day moving average continues to hover above, while the shares attempt to hold above recent two-year lows below the $3 level. Year-over-year, TLRY is 69.2% lower, but the equity is seeing buzz within its sector, after President Biden yesterday pardoned cannabis-related federal offences.

Ambac Financial Group, Inc. (NYSE:AMBC) stands near the top of the New York Stock Exchange (NYSE), last seen 10.1% higher to trade at $14.05, after settling its RMBS litigations against Bank of America (BAC) for $1.84 billion. Today's pop has the security on track to snap a four-week losing streak, though it remains roughly 9% lower year-to-date.

Roblox Corp (NYSE:RBLX), meanwhile, is 8.6% lower, trading at $35.77 at last glance, after a lawsuit this week accused the online gaming firm, per a report from Reuters, of enabling a California girl's sexual and financial exploitation by adult men. Year-to-date, RBLX is 65.4% lower.