The S&P 500 is coming off its biggest two-day gain since March 2020

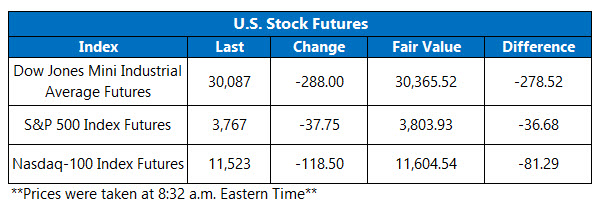

Stock futures are taking a breather from October's two-day rally, with Dow Jones Industrial Average (DJI) futures set for a 288-point drop. Futures on the Nasdaq-100 (NDX) and S&P 500 (SPX) sit deep in the red as well, as the latter comes off its best two-day gain since March 2020. Meanwhile, bond yields are back on the rise, though the 10-year Treasury yield still sits below last week's highs near 4%.

Wall Street is also unpacking the latest ADP jobs report, showing businesses added 208,000 jobs in September. The number topped estimates, and marked a rise from August's reading.

Continue reading for more on today's market, including:

- It's time to bet on a downturn for Ross Stores stock.

- Options bulls came around to this surging biotech name.

- Plus, Musk puts TWTR deal back on the table; and 2 big names attracting bull notes.

5 Things You Need to Know Today

- The Cboe Options Exchange (CBOE) saw more than 1.14 million call contracts and 733,697 put contracts traded on Tuesday. The single-session equity put/call ratio fell to 0.64, while the 21-day moving average stayed at 0.68.

- After months of drama and a lawsuit, Tesla (TSLA) CEO Elon Musk is once again proposing a Twitter Inc (NYSE:TWTR) takeover. Musk wants to buy TWTR for his original offer of $54.20 per share. In response, the social media stock is down 0.7% ahead of the bell. Year-to-date, however, TWTR has added 20.3%.

- Bernstein initiated coverage of Airbnb Inc (NASDAQ:ABNB) with an "outperform" rating and a $143 price target today -- a nearly 30% premium from Tuesday's close. The stock was last seen up 0.6% in premarket trading, but remains down 33.4% in 2022.

- Morgan Stanley just hit Ford Motor Company (NYSE:F) with an upgrade, hiking its rating to "overweight" from "equal weight." The analyst noted a buying opportunity in the stock's recent dip. Ford Motor stock was last seen up 1.1%, though it has been struggling to mitigate a nasty 40.5% year-to-date deficit.

- There's a lot on the docket today, including international trade balance data, the pending home sales index, S&P services PMI, and the ISM services index.

Euro Zone PMI Hits 20-Month Low

Stocks in Asia popped once again Wednesday. Hong Kong’s Hang Seng added 5.9% on its return from a holiday, buoyed by tech and bank stocks. Meanwhile, Japan’s Nikkei rose 0.5%, and South Korea’s Kospi tacked on 0.3%, after the country’s consumer price index (CPI) showed inflation cooled in September. China’s Shanghai Composite, meanwhile, remained closed for the Golden Week holiday.

European markets are taking a step back today, after the euro zone’s composite purchasing managers’ index (PMI) hit a 20-month low for September. At last check, London’s FTSE 100 is down 1%, and France’s CAC 40 has lost 0.7%. In Germany, the DAX is 0.9% lower, after an Ifo Institute survey showed more companies plan to hike food, gas, and electricity prices.