There is equity weakness globally, per the British pound falling to record lows

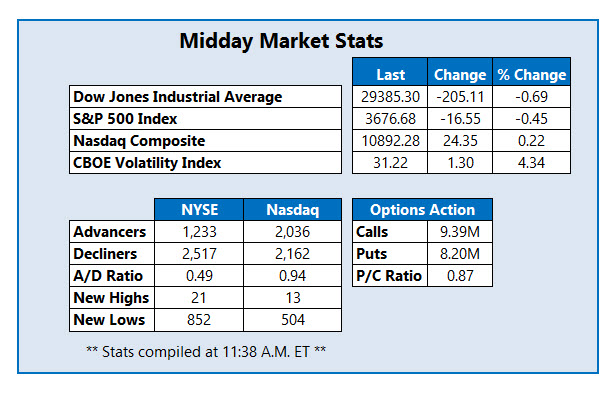

This morning's news of the British pound at record lows is still echoing through Wall Street at midday, with the Dow Jones Industrial Average (DJI) and S&P 500 Index (SPX) both heading toward a fifth straight loss. The Nasdaq Composite (IXIC) has managed to brush off some of this pessimism as the tech sector shows some much-needed strength.

The noise surrounding the Fed's rate hike last week has grown cacophonous, with several big names putting in their two cents. Boston Federal Reserve President Susan Collins demanded "clear and convincing signs" that inflation is on its way down before the central bank starts easing up on its monetary policy. Meanwhile, Wharton professor Jeremy Siegel said Fed Chair Jerome Powell owes "the American people an apology" for his recent and sudden attempts to crack down on inflation.

Continue reading for more on today's market, including:

- Can Dollar Tree stock finally rise after naming new COO?

- Analyst: Uber has the upper hand in ride-share wars.

- Plus, BCS blasted by bears; casino sector surges; and GSUN cools off.

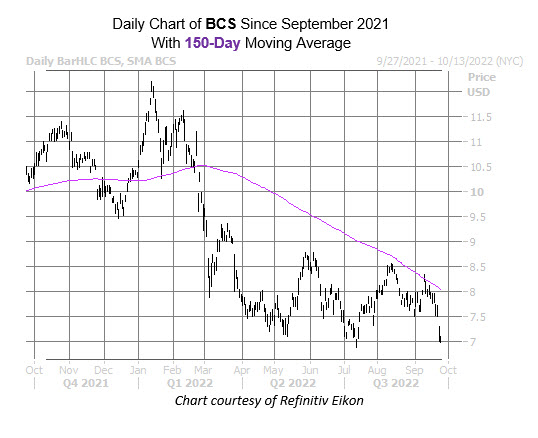

Barclays PLC (NYSE:BCS) is seeing an surge in bearish options activity today, with put volume running at 12 times the intraday average. The most popular is the October 7 put, followed distantly by the 7-strike call in the same series, with new positions being bought to open at the latter. BCS was last seen down 0.7% at $7.03, and though there seems to be no driving catalyst for this wild options trading, option volume on Barclays was unusually high on Friday as well. BCS is near its July 14 annual low of $6.88 and now sports a year-to-date deficit of 33.5%. Pressure at the 150-day moving average has kept a lid on two of the security's most recent rally attempts.

Melco Resorts & Entertainment Ltd (NASDAQ:MLCO) is one of the top performers on the Nasdaq today, last seen up 29.3% at $6.85. The stock is benefitting from the casino sector’s surge, after news that Macau will allow mainland Chinese tour groups in November for the first time in nearly three years. MLCO has been consolidating above the $5 level for the past few months, and is now trading at its highest level since April, though the 200-day moving average appears to be keeping a cap on today’s rally. Year-to-date, the equity is down 31.9%.

One of the worst performing stocks on the Nasdaq today is Golden Sun Education Group Ltd (NASDAQ:GSUN). The equity is down 17.9% at $43.43 at last glance, pulling back from Friday’s 921% surge to $52.89. The equity burst onto the scene in June, and has added nearly 100% in the last three months as it moves well above its initial public offering (IPO) price of $4 per share.