The Fed's two-day policy meeting has investors on edge

Stocks are struggling for direction midday. The Dow Jones Industrial Average (DJI) was last seen slightly below breakeven, while the S&P 500 Index (SPX) and the Nasdaq Composite (IXIC) are back in the red, after all three major indexes saw a brief foray into positive territory.

This volatility -- triggered as the 10-year Treasury yield surged to its highest level in 11 years this morning -- comes ahead of the Federal Reserve's two-day policy meeting, that kicks off tomorrow and is expected to bring yet another aggressive interest rate hike. In other news, the NAHB home builders' index fell for the ninth-straight month, and Bitcoin (BTC) earlier hit its lowest level in three months.

Continue reading for more on today's market, including:

- Grand Theft Auto leak weighs on video game stock.

- AutoZone stock rises on strong same-store sales.

- Plus, options bears circling GOOS; acquisition buzz drives cannabis stock to all-time highs; and pharma stock bottoms out.

Options bears are blasting Canada Goose Holdings Inc (NYSE:GOOS) today, with 12,000 calls exchanged so far -- 54 times the volume that is typically seen at this point -- compared to just 45 calls. Most popular by a long shot is the weekly 10/7 15-strike put, with new positions being opened there. GOOS is up 1% to trade at $17.41 at last glance, after an upgrade from Williams Trading to "hold" from "sell." The stock was turned away at $20 last week, sits near annual lows of $16.65, and is down 52.7% year-to-date.

BYND Cannasoft Enterprises Inc (NASDAQ:BCAN) is one of the top performers on the Nasdaq today, last seen up 128.9% at $9.50. Today's massive bull gap comes after the company agreed to acquire Israel-based Zigi Carmel Initiatives & Investments in a share swap valued at $28 million. BCAN earlier hit an all-time high of $16.38, and has added a whopping 82.5% quarter-to-date.

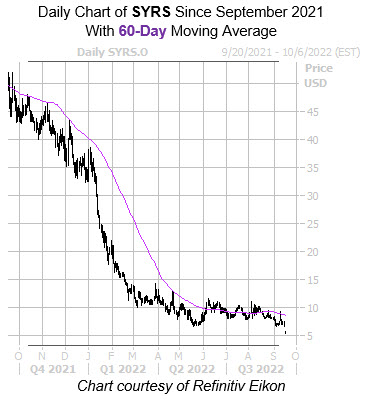

Meanwhile, Syros Pharmaceuticals Inc (NASDAQ:SYRS) is near the bottom of the Nasdaq. Last seen down 26.6% at $5.39, the company executed a 1-10 reverse split this morning, after on Friday announcing the closing of a merger with Tyme Technologies. SYRS earlier slipped to an all-time low of $5.25, guided lower by its descending 60-day moving average. Year-over-year, the equity is down 89.2%.