All three indexes have pared sharp losses from the morning

The Dow Jones Industrial Average (DJI) is 54 points higher midday, paring steep morning losses as traders unpack stronger-than-anticipated PMI data. Both the S&P 500 Index (SPX) and Nasdaq Composite (IXIC) have also fought their way out of the red and sit marginally above breakeven at last check. The latter is hoping to snap a six-day losing streak today, even though the tech-heavy index is weighed down by surging Treasury yields.

Continue reading for more on today's market, including:

- Analyst praise failed to boost this travel stock.

- FedEx stock downgraded on macro headwinds.

- Plus, biotech name seeing red-hot options activity; ADT surges on investment buzz; and GETY extends selloff.

Biotech name IVERIC bio Inc (NASDAQ:ISEE) is seeing ramped up options activity today. So far, 39,000 calls and 43,000 puts have crossed the the tape, volume that's 16 times what's usually seen at this point. The most popular is the September 7.50 put, followed by the 5 call in the same standard series. The equity is up 51.7% at $14.32 at last check, after the company's eye drug candidate for Geographic Atrophy (GA) met the main goal of a late-stage trial. In response, ISEE received a price-target hike from Credit Suisse to $27 from from $24, and is trading at it highest level since May. Quarter-to-date, the shares are up 42%.

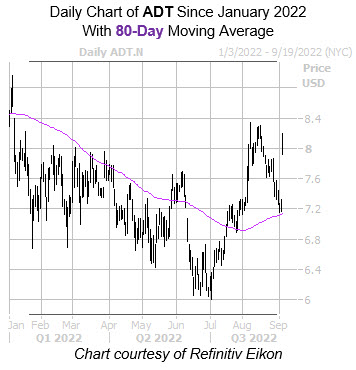

ADT Inc (NYSE: ADT) is one of the best stocks on the New York Stock Exchange (NYSE) today, last seen up 13% to trade at $8.15. The company scored a $1.2 billion investment from State Farm on a partnership for its smoke detection and anti-intrusion products, and an extra $150 million from Alphabet (GOOGL) for product development. The shares are bouncing off a pullback to the $7.10 region, which was captured by its 80-day moving average. Over the last quarter, ADT has added 31.4%.

Meanwhile, Getty Images Holdings Inc (NYSE:GETY), is towards the bottom of the NYSE, last seen down 12% to trade at $13.08, though there was no clear reason for this negative price action. The security has tumbled down the charts since its Aug. 2, all-time high of $37.88, shedding nearly 45% on Friday, and could today breach its 100-day moving average.