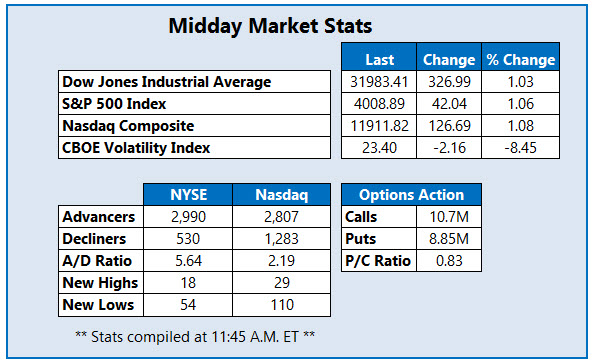

The Dow is 326 points higher this afternoon

Stocks are rallying on the heels of today's strong jobs report, with nonfarm payrolls rising in line with analysts' expectations. At least for a day, the report is easing fears that the central bank would become even more aggressive with interest rate hikes. The Dow Jones Industrial Average (DJI) is up 326 points midday, while the S&P 500 Index (SPX) and Nasdaq Composite (IXIC) stand firmly higher this afternoon as well. Though the major indexes are paring recent losses, they remain on track for a third-straight week in the red.

Continue reading for more on today's market, including:

- Starbucks stock inches higher on new CEO buzz.

- Athleisure stock pops after top- and bottom-line win.

- Plus, SG seeing ramped up options activity; Smartsheet stock brushes off bear notes; and a sinking Wall Street newbie.

Sweetgreen Inc (NYSE:SG) is getting blasted in the options pits today, with 11,000 calls and 5,011 puts across the tape so far, volume that is 14 times the intraday average. The most popular is the September 12.50-strike put, followed by the 20-strike call in the standard series. It's unclear what's driving ramped up options activity, with the shares last seen down 2.1% to trade at $16.75 at last check. The equity has been testing a floor at the $16 region of late, after failing to conquer the $22 level during its mid-August rally.

Among the top gainers on the New York Stock Exchange (NYSE) today is Smartsheet Inc (NYSE:SMAR), last seen up 11.5% at $34.37. The company just yesterday reported narrower-than-expected second-quarter losses and a revenue beat, and is brushing off a slew of bear notes, with seven analysts lowering their price targets, including a cut to $37 from $40 at Citigroup. The shares are bouncing off a recent pullback to the $30 area, but long-time overhead pressure remains at the 100-day moving average.

Shuttle Pharmaceuticals Inc (NASDAQ:SHPH), meanwhile, is among the Nasdaq's worst performers. The Wall Street newbie surged almost 400% during its Wednesday debut, trading as high as $84.70 before closing out at $38.48, compared to its initial public offering (IPO) price of $8.12. Last seen down 68.7% at $16.41, the security is being closely watched on social media forum stocktwits.com, after selling 1.2 million units.