Nasdaq futures are benefitting from Tesla's earnings beat

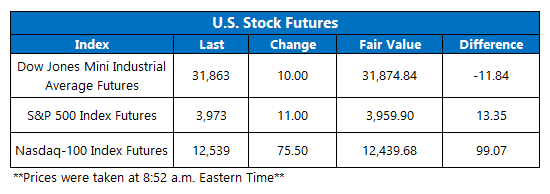

Futures on the Dow Jones Industrial Average (DJIA) and the S&P 500 Index (SPX) are trading near breakeven this morning, following a fresh batch of corporate earnings. Elsewhere, Nasdaq-100 Index (NDX) futures are eyeing a pop on the heels of Tesla's (TSLA) quarterly report.

In other news, U.S. jobless claims hit an eight-month high. Initial unemployment claims jumped to 251,00 for the week ending on July 16 -- well above the 240,000 figure Wall Street anticipated -- while continuing claims jumped to their highest level since April.

Continue reading for more on today's market, including:

- This cybersecurity stock has room to run.

- Read this before you start rolling options.

- Plus, digging into Tesla's earnings report; what's weighing on UAL; and Carnival's stock offering.

5 Things You Need to Know Today

- The Cboe Options Exchange (CBOE) saw more than 1.24 million call contracts and 767,907 put contracts traded on Wednesday. The single-session equity put/call ratio rose to 0.63, and the 21-day moving average stayed at 0.67.

- Tesla Inc (NASDAQ:TSLA) boasts a 2.6% premarket lead, after the electric vehicle (EV) giant reported second-quarter earnings that beat analysts' estimates. However, the company's revenue came in below forecasts, while profits margins thinned as costs rose and supply chain issues persisted. Year-to-date, TSLA is 29.7% lower.

- Higher jet fuel prices and a possible lag in economic growth are weighing on United Airlines Holdings Inc (NASDAQ:UAL), leading the company to miss both top- and bottom-line expectations for the second quarter. UAL is sliding before the open, last seen down 7%, and already sports a 10% year-over-year deficit.

- Cruise line operator Carnival Corp (NYSE:CCL) announced a $1 billion common stock offering, with plans to use the proceeds for general corporate purposes. The equity is cratering in response, down 12.4% before Wall Street's opening bell, and set to add to its 44.9% year-to-date dip.

- The Philadelphia Federal Reserve manufacturing index and leading economic indicators are on tap today.

ECB Issues First Interest Rate Hike in 11 Years

Asian markets settled on both sides of the aisle on Thursday. Japan’s Nikkei added 0.4%, after the Bank of Japan kept its easy monetary policy and let the weak yen be. The South Korean Kospi gained for the day as well, adding 0.9%, while China’s Shanghai Composite and Hong Kong’s Hang Seng fell 1% and 1.5%, respectively, with real estate stocks weighing on the latter.

Meanwhile, over in Europe, the European Central Bank (ECB) increased interest rates for the first time in 11 years. London’s FTSE 100 is down 0.4% midday, as the country still reels from yesterday’s hotter-than-expected inflation data. Elsewhere, the French CAC 40 is down 0.04%, while the German DAX sheds 0.8%.