All three major benchmarks logged a second-straight weekly loss

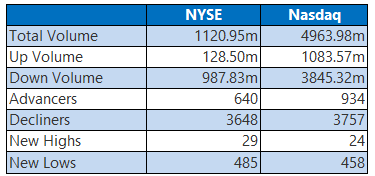

A historically dismal consumer price index (CPI) reading for May -- the highest since 1981 -- delivered a fatal blow to stocks on Friday. The Dow fell 880 points, while the Nasdaq and S&P 500 settled sharply lower as well, as all three major indexes logged their third-straight daily loss, and a second consecutive week in the red. The Dow also marked a 10th losing week out of 11. Conversely, the Cboe Volatility Index (VIX), "Wall Street's fear gauge," registered its best week since late April.

Though the selloff has impacted virtually every sector, tech stocks in particular were under pressure as bond yields rose. The alarming inflation reading has traders even more concerned about a potential recession, as it may prompt aggressive interest rate hikes from the U.S. Federal Reserve.

Continue reading for more on today's market, including:

The Dow Jones Average (DJI - 31,392.79) dropped 880 points, or 2.7%, for the day, and 4.6% for the week. Walmart (WMT) was the only gainer, adding 0.6%. Dow (DOW), meanwhile, paced the laggards with a 6.1% drop.

The S&P 500 Index (SPX - 3,900.86) shed 117 points, or 2.9% for the day, and 5.1% for the week. Meanwhile, the Nasdaq Composite (IXIC - 11,340.02) lost 414.2 points, or 3.5% for the session, and 5.6% for the week.

Lastly, the Cboe Market Volatility Index (VIX - 27.75) added 1.7 points, or 6.4% for the day, and 12% for the week.

5 Things to Know Today

- The Biden administration will drop the Covid-19 testing requirement for travelers entering the U.S. on Sunday, after several calls from travel industry players. (CNBC)

- Consumer sentiment fell to a worse-than-expected, record low reading of 50.2 in June, down from 58.4 in May, per this University of Michigan survey. (MarketWatch)

- Why bear notes rolled in for DocuSign stock today.

- Goldman Sachs has turned bearish on Netflix stock.

- Roblox's lower revenue growth is making analysts nervous.

Gold Prices Surge as Rate Hike Fears Spiral

Oil prices were lower on Friday, but settled just barely above the $120 mark. The red-hot inflation reading pushed the U.S. dollar higher, and weighed on the commodity sector as it did on equities. July-dated crude fell 84 cents, or 0.7%, to settle at $120.67 per barrel. For the week, black gold managed to walk away with a 1.5% gain.

Meanwhile, gold prices surged, notching their best day in one week. Investors flocked to the safe-haven commodity today as fears the Federal Reserve may tighten its economic policy spiraled. August-dated gold rose 1.2%, or $22.70, to close at $1,875.50 an ounce, and added 1.4% for the week.