The Dow is down nearly 100 points midday

Another jump in bond yields is weighing on markets midday, with the Dow Jones Industrial Average (DJI) last seen down 97 points, while the S&P 500 Index (SPX) has headed lower as well. Meanwhile, the Nasdaq Composite (IXIC) is eyeing a quiet gain as China-based tech stocks bounce.

The 10-year Treasury yield is on the rise, hovering around 3%, as investors fret over the slowing pace of the economy and the chance of another recession. This fear is undoubtedly being stoked by the Atlanta Federal Reserve's GDPNow tracker, which showed second-quarter growth rate of just 0.9%, falling from 1.3% last week.

Continue reading for more on today's market, including:

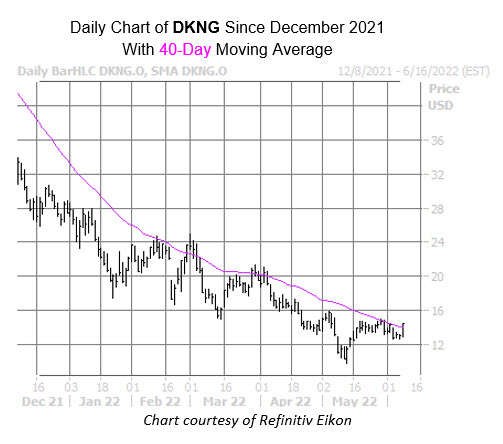

There is an unusual amount of bullish options activity surrounding DraftKings Inc (NASDAQ:DKNG) today, with 46,000 calls across the tape at last check, which is double the intraday average and almost triple the number of puts traded. The weekly 6/10 14.50-strike call is the most popular, followed distantly by the 15-strike call in the same weekly series. Positions are being bought to open at the former. DKNG was last seen up 10.9% to trade at $14.34. Should these gains hold, the security could notch its first close above the 40-day moving average since early April.

Software stock Cyren Ltd (NASDAQ:CYRN) is one of the best performing stocks on the Nasdaq today. The equity was last seen up 27.7% to trade at $2.26, following news that the company has entered into an all-cash deal to sell its legacy Secure Email Gateway unit to Content Services Group GmbH for 10 million euros (or $10.70 million). CYRN still suffers a near 60% year-to-date deficit, though today's pop has it well above recent pressure at the 30-day moving average for the first time in two months.

One of the worst performers on the Nasdaq, on the other hand, is Loyalty Ventures Inc (NASDAQ:LYLT). The equity was last seen down 56.4% to trade at $4.81. The company said earlier during an update from its air miles rewards program that it's re-evaluating its 2022 revenue and EBITDA guidance amid trouble agreeing on extension turns with its sponsor Sobey. LYLT is trading at record lows, and is now down 82% in 2022.