The Nasdaq and S&P 500 are also sharply lower this afternoon

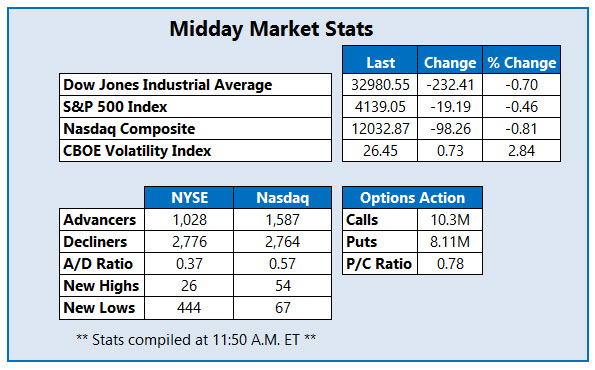

Stocks are lower at midday, as oil prices skyrocket following the European Union's (EU) decision to ban most Russian crude imports. Inflation fears are taking hold as well, after sharp rises across the pond. In turn, the Dow Jones Industrial Average (DJI) is down 232 points this afternoon, pacing for its first loss in six sessions. Meanwhile, the S&P 500 Index (SPX) and Nasdaq 100 Index (NDX) are also both lower, and looking to snap three-day win streaks. Should these losses hold, all three major benchmarks could log a second consecutive monthly loss.

Continue reading for more on today's market, including:

- Easing Covid-19 restrictions boost Chinese EV stock.

- Now's the time to buy Zoom stock, according to this analyst.

- Plus, options traders target HTH; Mesa Royalty stock pops; and unpacking this lithium stock's dip.

Hilltop Holdings Inc. (NYSE:HTH) is getting blasted in the options pits today. So far, 13,000 calls and 13,000 puts have been exchanged, which is nine times what's typically seen at this point. The most popular contracts are the June 40 call and put. The equity is down 1.1% at $29.49 at last check, after the company announced the preliminary results of its tender offer. Specifically, Hilltop will buy roughly 14.9 million shares at $29.75 each. The security has been testing a floor at the $28.50 level since its May rally, with support from the 30-day moving average. However, the $30.50 area has since emerged as a ceiling, and year-to-date HTH is down 16%.

Sitting near the top of the New York Stock Exchange (NYSE) today is Mesa Royalty Trust (NYSE:MTR), last seen up 14% to trade at $20. There is no apparent reason for today's positive price action, but the equity is just off a May 27, roughly seven-year high of $28, with support from the 20-day moving average. Year-to-date, MTR is already up 227.6%.

Towards the bottom of the NYSE is Lithium Americas Corp (NYSE:LAC). The security is down 8.7% to trade at $25.70, though a catalyst for this negative price action remains unclear. The stock could also snap a five-day win streak today, should these losses hold, after a familiar ceiling at the $37 level rejected a recent bounce off its lowest level since October. The 140-day moving average is also pressuring the shares lower, while year-over-year LAC is still up 74.3%.