The Nasdaq and S&P 500 are also swimming in red ink

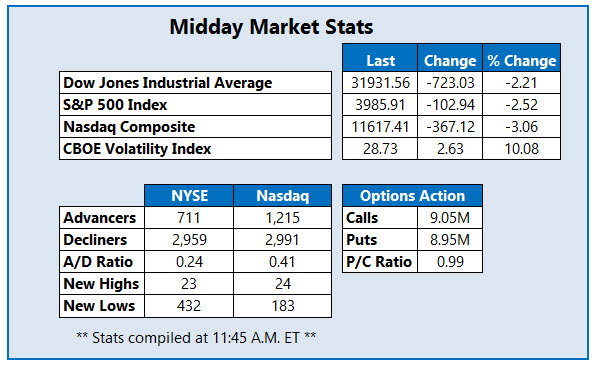

Stocks are rapidly extending this morning's selloff midday, after Target's (TGT) quarterly earnings report brought recent inflationary pressures and high gas prices to the forefront. The Dow Jones Industrial Average (DJI) is down 723 points at last check, while the S&P 500 Index (SPX) and Nasdaq Composite (IXIC) are both swimming deep in red ink as well. Amid today's sharp pivot lower, Wall Street's "fear gauge," the Cboe Volatility Index (VIX), is on track to snap a six-day losing streak.

Continue reading for more on today's market, including:

- The revenue miss that crumbled Lowe's stock.

- Penn National Gaming stock scored a big bull note.

- Plus, options bears target M; semiconductor name surges on buyout bid; and pre-earnings headwinds hit BJs Wholesale Club stock.

Macy's Inc(NYSE:M) is seeing an unusual amount of bearish options activity today. Across the tape so far are 64,000 puts and 16,000 calls, volume that's seven times what is typically seen at this point. The May 18.50 put is the most popular, with new positions being opened, while the June 18 put is also seeing notable action. Last seen down 7.7% at $19.68, there's no clear catalyst for the security's negative price action, though dismal earnings reports from retailers such as Lowe's (LOW) and Target (TGT) could be dragging the shares lower. Macy's stock earlier fell to its lowest trading level since August, and is has shed roughly 36% in the last six months.

Magnachip Semiconductor Corp(NYSE:MX) is bucking the broad-market pullback and sits atop the New York Stock Exchange (NYSE) today. The stock is up 14.2% to trade at $19.61 at last check, after South Korea's LX Group and private equity firm Carlyle Group (CG) reportedly submitted a bid to buy the company. MX is now eyeing its highest close since January, after hitting an April 25 annual low of $14.66.

Towards the bottom of the NYSE and in a pool of struggling retailers is BJs Wholesale Club Holdings Inc (NYSE:BJ). Last seen down 16.5% to trade at $53.24, the company will report first-quarter earnings before the open tomorrow, May 19. The shares have a generally positive history of next-day reactions, finishing five of eight next-day sessions higher over the past two years, including a 21.7% surge in May 2020. Still, the security earlier breached long-time support at the 300-day moving average to trade at its lowest level since early October. Year-to-date, BJ is down 20.8%.