The Nasdaq and S&P 500 are also lower at midday

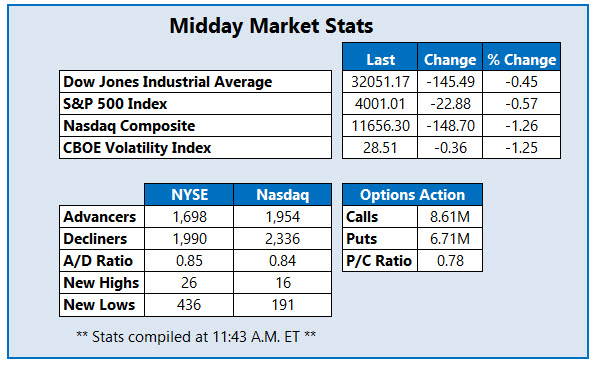

Stocks are lower at midday, as Wall Street struggles to shake off high inflation, and the prospect of aggressive interest rate hikes. The Dow Jones Industrial Average (DJI) is 145 points lower this afternoon -- erasing this morning's modest gains -- while the S&P 500 Index (SPX) and Nasdaq Composite (IXIC) are firmly in the red as well. The tech sector is struggling once again, with Google-parent Alphabet (GOOGL) and Microsoft (MSFT) each shedding 1% earlier. Investors are now turning to this week's slew of retail earnings reports, as well as retail sales data.

Continue reading for more on today's market, including:

- Airline stock surges following hostile takeover bid.

- Why Wedbush believes Netflix stock could rebound.

- Plus, HEAR calls pop after settlement; Griffon stock bounces on strategic review; and checking in on this struggling e-commerce name.

Options bulls are buying Turtle Beach Corp (NASDAQ:HEAR) today, after the gaming accessory maker gave three board seats to Donerail Group, an investment firm that owns 7.4% of Turtle Beach's outstanding shares. The deal is part of a settlement with the activist investor and other shareholders, which includes the creation of a strategic review committee. As a result, 20,000 call have crossed the tape so far, which is 11 times the intraday average, compared to 32 puts. Most popular by a long shot is the May 20 call, followed by the 21 call in the same monthly series. HEAR was last seen up 5.1% to trade at $17.52, bouncing off a May 12, roughly two-year low of $14.05. What's more, the shares are today eyeing their first close above the 20-day moving average since early April.

Griffon Corporation (NYSE:GFF) is the best stock on the New York Stock Exchange (NYSE) today. Shares are up 23.5% to trade at $30.01 at last check, after the company said it started a process that will review a comprehensive range of strategic alternatives to maximize shareholder value. The security earlier surged to an all-time high of $30.39, and is on pace to notch its best session since 1987, while breaking through overhead pressure at the 320-day moving average.

Meanwhile, Shopify Inc (NYSE:SHOP) is towards the bottom NYSE. The shares were last seen down 10.7% at $359.49, though a catalyst for this negative price action is still unclear. The shares have tumbled on the charts since November, culminating in a May 12, two-year low of $308.06. Over the last nine months, Shopify stock is down more than 75%.