The Dow lost more than 1,000 points

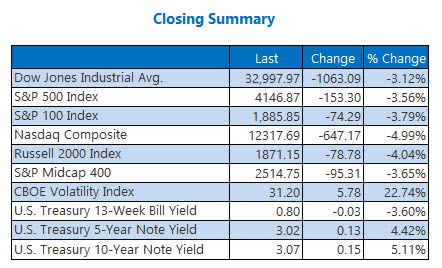

Wall Street's selloff intensified midday and didn't let up, as the major benchmarks all snapped a three-day win streak. The Dow finished Thursday more than 1,000 points lower, after the 10-year Treasury yield surged back above 3% and labor productivity fell at its sharpest quarterly rate in nearly 75 years. The S&P 500 also closed firmly in the red, while the Nasdaq suffered a massive triple-digit loss, as interest rates dented growth-focused tech stocks. Ultimately, the Dow and Nasdaq each logged their worst day since June 2020.

Continue reading for more on today's market, including:

- This cybersecurity stock boasts an intriguing entry point.

- Bulls should target little known PBF Energy stock.

- Plus, 3 stocks that plunged after reporting quarterly earnings results.

The Dow Jones Average (DJI - 32,997.97) shed 1,063.1 points, or 3.1% for the day. Every Dow component walked away with a loss today, and Salesforce.com (CRM) paced the bottom of the list with a 7.1% dip.

The S&P 500 Index (SPX - 4,146.87) fell 153.3 points, or 3.6% for the day, and the Nasdaq Composite (IXIC - 12,317.69) lost 647.2 points, or 5% for the day.

Lastly, the Cboe Market Volatility Index (VIX - 31.20) added 5.8 points, or 22.7% for the day.

5 Things To Know Today

- Following his $44 billion takeover, Elon Musk is expected to become Twitter's temporary CEO. (Reuters).

- The Fed's interest rate hikes are already hitting new mortgages, with the benchmark 30-year mortgage rate hitting its highest point since August 2009. (MarketWatch)

- Unpacking Shopify's dismal earnings report.

- Etsy stock paces for worst day in two years.

- More on eBay stock's bear note barrage.

Due to technical issues, we are unable to provide an unusual volume chart today.

We apologize for the inconvenience.

Gold Ekes Out Win After Trading Above $1,900 Earlier

Oil prices moved higher on Thursday, as the European Union (EU) moved closer to banning Russian crude imports. Additionally, the Organization of the Petroleum Exporting Countries and its allies (OPEC+) agreed to a increase monthly oil output by a modest amount, despite the recent price rally. June-dated crude added 45 cents or 0.4%, to close at $108.26 per barrel.

The Treasury yield's surge, a rising U.S. dollar, and Wall Street's selloff gave gold futures a small victory today. Specifically, June-dated gold added $6.90, or 0.4%, to settle at at $1,875.70 an ounce, after trading above $1,900 per ounce earlier.