All three major benchmarks are pacing for monthly losses

Stock futures are pointed lower for the last trading session of April. Futures on the Dow Jones Industrial Average (DJIA) are pacing for a 91-point drop, while S&P 500 Index (SPX) and Nasdaq-100 Index (NDX) futures are also eyeing losses, despite all three major indexes yesterday scoring their best day since March. Investors are unpacking the latest inflation data, with the core personal consumption expenditures price (PCE) index jumping 5.2% year-over-year for March, in comparison to an estimated 5.3% pop. For the month, the benchmarks are eyeing sharp losses, as the Nasdaq in particular paces for its worth month since March 2020.

Continue reading for more on today's market, including:

- This blue-chip stock is the worst to own in May.

- Pfizer stock is anything but a safe bet for investors.

- Plus, unpacking Chevron's blowout earnings; Roku stock pops on revenue win; and dismal revenue guidance pressures AMZN.

5 Things You Need to Know Today

- The Cboe Options Exchange (CBOE) saw more than 1.3 million call contracts traded on Thursday, and 929,810 contracts. The single-session equity put/call ratio rose to to 0.71, and the 21-day moving average stayed at 0.58.

-

Chevron Corporation (NYSE:CVX) is down 1.1% ahead of the bell, brushing off blowout first-quarter earnings and revenue. The blue-chip oil concern saw quarterly profits quadruple, amid

surging oil and gas prices, and announced it would triple its share buyback program to $30 billion. Over the past nine months, CVX has added 57.7%.

-

The shares of

Roku Inc (NASDAQ:ROKU) are up 4.1% before the open, after the

streaming name posted better-than-expected revenue of of $733.7 million for the first quarter. Longer term, Roku stock still carries a hefty 74.7% year-over-year deficit.

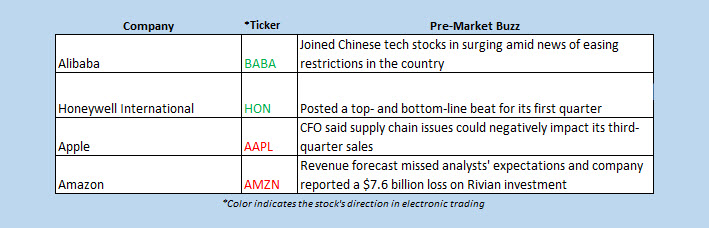

- Amazon.com, Inc. (NASDAQ: AMZN) is sinking in the premarket, last seen down 9.9%. Today's bear gap came after the e-commerce name's second-quarter revenue guidance came in well below Wall Street's estimates. Plus, the company said it lost $7.6 billion in its Rivian Automotive (RIVN) investment. Year-to-date, AMZN is down 13.3%.

- A slew of economic data is due, including the employment cost index, nominal personal income, in addition to consumer spending and real disposable income data. The Chicago Purchasing Manager's Index (PMI) is expected, and will be accompanied by the University of Michigan's consumer sentiment index and five-year inflation expectations.

European Markets Rise Despite Russia Tensions

Asian markets soared on Friday, with Chinese technology stocks surging alongside the Nasdaq’s overnight gains. As a result, Hong Kong’s Hang Seng led the charge, adding 4%, while China’s Shanghai Composite rose 2.4%. Also boosting sentiment was a state media report, which showed officials in the country promising more policy support in order to meet economic growth goals for the year. Elsewhere, South Korea’s Kospi tacked on 1%, and Japan’s Nikkei was closed for a holiday.

Meanwhile, stocks in Europe are pacing for wins today, though they remain on track to log monthly losses. Investors continue to digest the latest corporate earnings reports, while also monitoring Russian President Vladimir Putin’s recent comments about a “lightning fast” response to any intervention from the West amid the former’s ongoing invasion of Ukraine. Additionally, euro zone inflation hit yet another record high for the month, marking its sixth-straight pop, after rising to 7.5% in April. At last check, London's FTSE 100 is up 0.4%, the French CAC 40 is 0.8% higher, and the German DAX is up 1%.