The VIX snapped its four-week losing streak

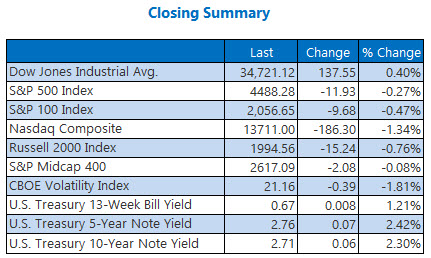

The major indexes finished the day mixed. The Dow rose 137 points, the S&P 500 closed just below fair value, and the tech-heavy Nasdaq sank triple digits as investors looked ahead toward rising interest rates. Weighed down by the Federal Reserve's aggressive policy plan this week, all three major indexes turned in weekly losses, while Wall Street's "fear gauge," the Cboe Market Volatility Index (VIX), snapped its four-week losing streak. Meanwhile, the market is gearing up for earnings season, which kicks off next week with reports from several big bank names.

Continue reading for more on today's market, including:

- The airline stock to avoid in April.

- Procter & Gamble received a brand-new bull note.

- Plus, behind CRWD's surge; HOOD downgraded; and KR gets a boost.

The Dow Jones Average (DJI - 34,721.12) added 137.6 points, or 0.4% for the day. Home Depot (HD) led the gainers with a 2.8% rise, while Boeing (BA) dropped to the bottom of the index with a 1.6% loss. The index lost 0.3% of the week.

The S&P 500 Index (SPX - 4,488.28) lost 11.9 points, or 0.3%, for the day, and 1.3% for the week. Meanwhile, the Nasdaq Composite (IXIC - 13,711.00) dropped 186.3 points, or 1.3% in today's session, and fell 3.8% for the week.

Lastly, the Cboe Market Volatility Index (VIX - 21.16) lost 0.4 point, or 1.8% for the day, but added 7.8% for the week.

5 Things To Know Today

- President Joe Biden gave a speech in celebration of Ketanji Brown Jackson's confirmation as the first Black woman on the Supreme Court. (Marketwatch)

- Echoing a move by the U.S., Britain added Vladimir Putin's daughters to its sanctions list today, as countries continue to target Russian elites. (MarketWatch)

- Why options bulls flocked to CrowdStrike this morning.

- HOOD slipped after a downgrade from Goldman Sachs.

- Behind Kroger stock's fresh record high.

There were no earnings of note today.

Oil Snags 2nd Weekly Loss

Oil prices moved higher for the day, but still finished with its second-straight week of losses, as the release of crude reserves weighed on prices this week. May-dated West Texas Intermediate (WTI) crude rose $2.23, or 2.3%, to close at $98.26 a barrel today, and lost 1% on the week.

Gold prices rose despite rising treasury yields. June-dated gold climbed $7.80, or 0.4%, to close at $1,945.60 an ounce, adding 1.1% for the week.