All three major benchmarks gained for the day and the week

Indexes closed the day higher after an intensely volatile last full week of January, as investors digest the Fed meeting, a slew of big-name earnings, and a historic comeback for the Dow. Chevron (CVX) is weighing heavy on the blue-chip index today, after reporting a disappointing earnings. Apple (AAPL) is providing some stability, however, and helped boost the blue-chip index to its best day of 2022 and tech-heavy Nasdaq to triple-digit gains. Meanwhile, the S&P 500 remains on track for its worst month since March 2020, but all three indexes managed a win for the week.

Continue reading for more on today's market, including:

- The latest name to jump aboard the S&P SmallCap 600.

- Weak earnings sends tech name to fresh annual low.

- Plus, earnings send blue-chip surging; 2 big 2022 correction developments; and the latest warning on Robinhood stock.

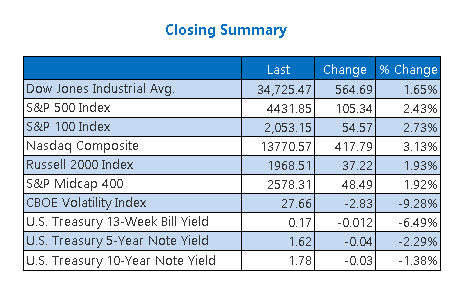

The Dow Jones Average (DJI - 34,725.47) climbed 564.69 points, or 1.7% for the day. Visa (V) led the gainers today, adding 10.6%, and Caterpillar (CAT) paced the laggards with a 5.2% drop. For the week, the Dow added 1.3%.

The S&P 500 Index (SPX - 4,431.85) moved 105.3 points higher, or 2.4%, while the Nasdaq Composite (IXIC - 13,770.57) tacked on 417.8 points, or 3.1%, for today's session. For the week, the indexes added 0.7% and 0.02%, respectively.

Lastly, the CBOE Volatility Index (VIX - 27.66) shed 2.8 points, or 9.3% for the day, and 4% for the week.

5 Things To Know Today

- Fourteen subpoenas have been issued by the House's Jan. 6 insurrection committee to a handful of "alternate electors," for former President Donald Trump. (MarketWatch)

- Per a judge ruling, California must continue to follow the net neutrality guidelines, which keep in place rules against internet providers interfering with web traffic.(CNBC)

- Record-setting earnings send this blue-chip surging.

- 2 important developments from the 2022 correction.

- Grave current-quarter warning slams Robinhood stock.

Oil Logs Impressive Daily, Weekly Wins

Oil logged an impressive six-week win streak today, alongside a daily close that settled at a seven-year high. Tensions surrounding Ukraine and Russian continue to add support to the increase in prices. March-dated oil added 21 cents, or nearly 0.2%, to settle at $86.82 per barrel. On the week, Oil added 2%.

Gold futures did not fare as well, however, marking their worst week in six, weighed down by the Fed's imminent rise in interest rates. The now most-active contract, April-dated gold, dropped $8.40, or 0.5%, to close at $1,786.60 per ounce. For the week, Gold shed 2.5%, its largest such decline since November.