All three major benchmarks are higher at midday

The Dow Jones Industrial Average (DJI) is 293 points higher midday, thanks in part to upbeat earnings from Microsoft (MSFT). The blue chip's quarterly win is providing a much-needed shot in the arm to tech and chip stocks, helping both the S&P 500 Index (SPX) and Nasdaq Composite (IXIC) brush off a rising 10-year Treasury yield.

Amid all of this positive price action, the Cboe Volatility Index (VIX) is on track to snap a six-day win streak. All eyes are now on the Federal Reserve's announcement later today, with traders hoping to decipher the central bank's next moves.

Continue reading for more on today's market, including:

- Options bears blast Boeing stock post-earnings.

- Why this analyst turned bullish on DraftKings stock.

- Plus, EQT calls running red-hot; CLNE pops on new agreement; and MYNZ cooling from record highs.

EQT Corporation (NYSE:EQT) is seeing an unusual amount of bullish options activity today. So far, 35,000 calls have already crossed the tape -- 32 times the intraday average -- compared to just 44 puts. Most popular is the March 23 call, followed by the 22-strike call in the same series, with new positions being opened at the former. EQT IS up 1.6% at $20.43 at last check and boasts a 28.4% year-to-date return.

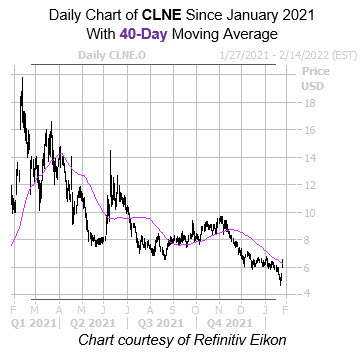

Clean Energy Fuels Corp (NASDAQ:CLNE) is near the top of the Nasdaq today, last seen up 14.3% at $6.30. Today's pop came after the company signed an agreement to build a methane capture digester for Millenkamp Cattle, a dairy farm in Idaho. CLNE is bouncing off a Jan. 24 annual low of $4.70, while pacing for a close above the 40-day moving average for the first time since November. The equity is still down 44.6% year-over-year, though.

Towards the bottom of the Nasdaq is Mainz Biomed BV (NASDAQ:MYNZ), last seen down 26.6% at $14.87 at last check, after the company yesterday priced its underwritten public follow-on offering of 1.5 million ordinary shares at $15 per share. The Wall Street newbie is cooling off from a Jan. 18, record high of $20, after going public in November with an initial public offering (IPO) price of $5 per share. Quarter-to-date, MYNZ is up 44.7%.