Wall Street is hyper-focused on the start of the Fed meeting

For most of the day, the major indexes looked to be extending their overwhelming losing streaks. However, within the last 15 minutes of trading, all three managed unbelievable rallies, with the Dow marking a never-before-seen comeback into the black, after earlier today suffering a more than 1,000-point deficit. The S&P 500 and tech-heavy Nasdaq also jumped into an unheard-of finish. Investors were seemingly wary ahead of tomorrow's introduction to the two-day Federal Reserve policy meeting.

Regardless, the SPX is still pacing toward its worst January performance on record, and the DJI and IXIC are steadying toward steep monthly deficits of their own. Wall Street's "fear gauge," or VIX, today surged its way to levels not touched since October 2020.

Continue reading for more on today's market, including:

- Blue-chip buckling before earnings.

- Put traders couldn't pass up this chip leader.

- Plus, analyst slams Snap; trading mistake to avoid in 2022; and the latest cannabis buzz.

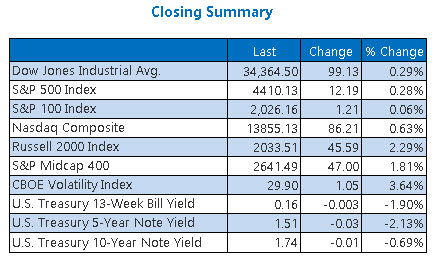

The Dow Jones Average (DJI - 34,364.50) managed to add 99 points, or 0.3% for the day. Home Depot (HD) led the gainers today, adding 4.2%, and Visa (V) paced the laggards with a 2% fall.

The S&P 500 Index (SPX - 4,410.13) moved 12.19 points higher, or 0.3%, while the Nasdaq Composite (IXIC - 13,855.13) added 86.2 points, or 0.6%, for today's session.

Lastly, the CBOE Volatility Index (VIX - 29.90) added 1 point, or 3.6% for the day.

- Retailer Kohl's (KSS) has been in focus today, as several buyout offers have surfaced. No fewer than two bids have been handed out. (CNBC)

- Former Alaska Gov. Sarah Palin has tested positive for Covid-19, thus delaying her libel lawsuit trial against the New York Times (NYT). (Reuters)

- Social media name just sank after this bear note.

- Schaeffer's Senior Market Strategist shares trading mistakes to avoid in 2022.

- Catch up on the latest buzz in the cannabis industry.

Oil Sinks Lower as Ukraine-Russia Tensions Continue

As a consequence of traders shedding riskier assets ahead of tomorrow's Fed meeting and tensions still rising with Ukraine and Russia, black gold sank lower. March-dated oil lost $1.83, or nearly 2.2%, to settle at $83.31 a barrel for the day.

As investors eye tomorrow's start to the two-day Fed meeting, Gold settled higher for Monday's session. February-dated gold added $9.90 or 0.5%, to close at $1,841.70 per ounce.