The 10-year Treasury yield is still climbing, though

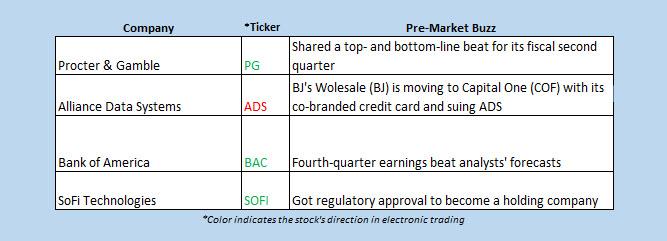

Fresh off yesterday's brutal beatdown, stock futures are pointing toward a cautious rally this morning. Futures on the Dow Jones Industrial Average (DJI), S&P 500 Index (SPX), and Nasdaq-100 Index (NDX) are all moving higher, even as the 10-year Treasury yield climbed to 1.9% earlier. Investors are unpacking the latest corporate reports, including an encouraging top- and bottom-line beats from blue-chip Procter & Gamble (PG).

Continue reading for more on today's market, including:

- Schaeffer's Senior V.P. of Research Todd Salamone tackles 2022's hot topic: treasury yields.

- Buy the dip on this REIT.

- Plus, Morgan Stanley scores earnings beat; Sony stock dragged lower by Microsoft deal; and another blue-chip in focus after earnings.

5 Things You Need to Know Today

- The Cboe Options Exchange (CBOE) saw more than 1.5 million call contracts traded on Tuesday, and 785,836 put contracts. The single-session equity put/call ratio fell to 0.52, and the 21-day moving average rose to 0.50.

- Morgan Stanley (NYSE:MS) stock is 0.9% higher in electronic trading, after the bank giant's fourth-quarter earnings exceeded analyst expectations. Revenue was in-line with estimates thanks to deal advisory fees stemming from merger and acquisition deals. MS is up 25% year-over-year heading into today.

-

Sony Corp (NYSE:SONY) stock is down 3.9% before the bell today, set to add to yesterday's 7.2% drop. The negative price action is in response to Microsoft's (MSFT) surprise move to buy

Activision Blizzard (ATVI) yesterday morning. SONY is down 14% already in 2022.

- The shares of UnitedHealth Group Inc (NYSE:UNH) are in focus this morning, after the blue-chip reported fourth-quarter earnings and revenue that topped Wall Street estimates. In response, Oppenheimer upped its price target to $550 from $475. UnitedHealth stock is up 31% in the last 12 months.

-

Building permits and housing starts updates are on deck, as well as the Philadelphia Fed manufacturing survey.

Asian Markets Tumble After U.S. Selloff

Asian markets fell on Wednesday, mirroring Wall Street’s selloff. Also weighing on sentiment was oil prices’ surge to almost eight-year highs, after Yemen’s Houthi rebels said they were responsible for this week’s attack in Abu Dhabi. Pacing the laggards was Japan’s Nikkei with a 2.8% drop, weighed down by Sony’s nearly 13% tumble after Microsoft (MSFT) said it would acquire Activision Blizzard (ATVI). Elsewhere, South Korea’s Kospi shed 0.8%, and China’s Shanghai Composite was 0.3% lower. Hong Kong’s Hang Seng settled modestly above breakeven with a 0.06% gain.

European markets are higher, on the other hand, as investors brush off rising U.S. bond yields. They are also digesting fresh inflation data out of the United Kingdom, with rates hitting a 30-year high in December, as energy costs and supply chain issues drove prices higher. Corporate earnings are in focus as well, as reports from the likes of Burberry and WH Smith roll in. At last check, France’s CAC 40 is up 0.7%, while both the German DAX and London’s FTSE 100 are 0.5% higher.