The Nasdaq and S&P 500 are holding onto their gains

Stocks are a choppy bunch midday, as Wall Street takes cues from Federal Reserve Chairman Jerome Powell. The Dow Jones Industrial Average (DJI) has pared triple-digit losses to sit above breakeven at last check, volatile after Powell noted during his confirmation hearing before Congress that the central bank would not hesitate to hike interest rates beyond expectations, should inflation stay high. The S&P 500 Index (SPX) and Nasdaq Composite (IXIC) are also hanging onto gains, despite trading in the red this morning.

Continue reading for more on today's market, including:

- What's pushing Juniper Networks stock higher.

- Intel stock popped after snatching competitor's CFO.

- Plus, options bulls eye CF; TSRI surges on record revenue; and unpacking HUDI's massive bear gap.

Agricultural manufacturer CF Industries Holdings, Inc. (NYSE:CF) is seeing an uptick in call activity today. So far, 25,000 calls have crossed the tape, volume that's 22 times what's normally seen at this point. Most popular is the May 75 call, followed by the 90 call in the same series, with new positions being opened at both. The shares are up 0.9% to trade at $68.07 at last check, though a catalyst for this price action was not immediately clear. CF had been cooling from a Dec. 28, record high of $74.77, and have added 57.8% year-over-year.

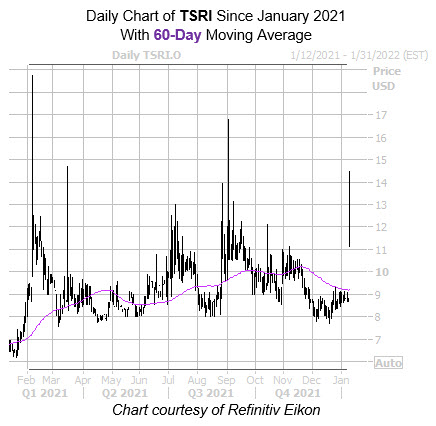

Among the best performing stocks on the Nasdaq today is TSR Inc (NASDAQ:TSRI), last seen up 30% to trade at $11.44, after the company reported a fiscal second-quarter revenue rose 48.5% year-over-year to a record $23.9 million. TSRI is trading at its highest level since September, toppling overhead pressure from the 60-day moving average. The equity now sports a 69.8% year-over-year lead.

Huadi International Group Co(NASDAQ:HUDI) is one of the worst performing stocks on the Nasdaq, last seen down 49.4% to trade at $13.87. It is not year clear what's driving today's massive bear gap, though shares were halted for volatility. Even after today though, HUDI has added a whopping 143.5% in the last three months.