The Dow and Nasdaq are both up triple digits midday

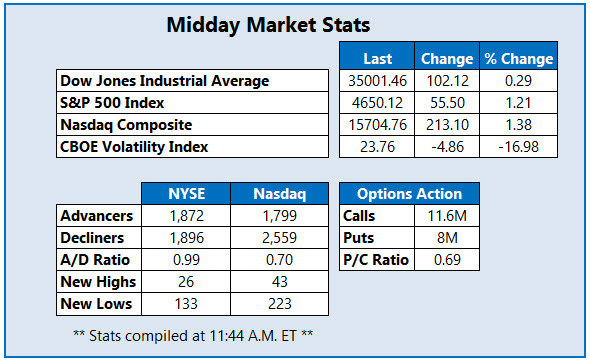

The Dow Jones Industrial Average (DJI) and Nasdaq Composite (IXIC) are both up triple digits midday, paring some of their losses from Friday's massive selloff. The S&P 500 Index (SPX) is sitting in the black as well, as the world watches for updates on the Covid-19 omicron variant, which the World Health Organization (WHO) has called a "variant of concern."

Wall Street's "fear gauge," the Cboe Volatility Index (VIX), has cooled off from its Friday spike, last seen down 17%. Elsewhere, retailers are in focus amid "Cyber Monday" sales, while pending home sales rose 7.5% in October -- much higher than Wall Street's anticipated 0.7%.

Continue reading for more on today's market, including:

- Eco-friendly footwear stock sees wave of fresh coverage.

- Zoom Video stock slumps despite renewed Covid-19 fears.

- Plus, LI options surge; KRYS doubles in value; and FENC plummets on FDA prediction.

China-based electric vehicle name Li Auto Inc (NASDAQ:LI) is seeing a surge in options activity today. The company's upbeat third-quarter revenue comes after vehicle deliveries nearly tripled for the quarter, while Li Auto also raised its fourth-quarter forecast. So far, 35,000 calls and 11,000 puts have crossed the tape, which is five times the intraday average. The weekly 12/3 36-strike call is the most popular, followed by the 35-strike call in the same series, with new positions being opened at both.

Soaring to the top of the Nasdaq today is Krystal Biotech Inc (NASDAQ:KRYS), up 114.9% at to trade at $85.56, after the company said its experimental topical drug, VYJUVEK, met the primary goal in a late-stage study for patients with dystrophic epidermolysis bullosa. To follow, Evercore ISI raised its price target to $125 from $100. Now trading at record highs, KRYS is up 44.3% year-to-date.

Meanwhile, Fennec Pharmaceuticals Inc (NASDAQ:FENC) is taking a dive into penny stock territory, down 49.7% to trade at $4.85, after the company noted it doesn't expect the U.S. Food and Drug Administration (FDA) to approve its treatment for preventing chemotherapy-induced hearing loss in pediatric patients. Now at a new annual low, long-term support at the $5 level could prop up today's bear gap.