The Dow is down triple digits midday

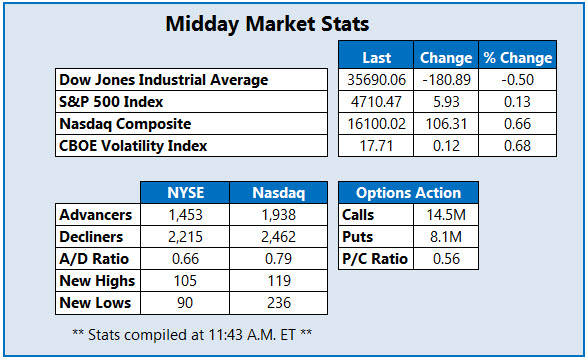

Stocks are mixed midday, as Wall Street warily eyes the resurgence of Covid-19 cases internationally. The Dow Jones Industrial Average (DJI) is down triple digits, on track for its third-straight daily loss and second-straight weekly loss. The S&P 500 (SPX) and Nasdaq Composite (IXIC), however, are both on track for weekly wins, while the former is eyeing muted gains and the latter is up triple digits.

Meanwhile, the The 2021 State Expenditure Report from the National Association of State Budget Officers showed U.S. states increased their spending by 16.2% for the fiscal 2021 year -- the fastest rate since the report started 35 years ago. There are several updates over in Washington as well, as the House of Representatives just voted to pass the $1.7 trillion infrastructure bill, which will likely see revisions from the Senate in the next couple weeks. Attention is also focused on President Joe Biden's upcoming choice for the next Federal Reserve chair, expected out this weekend.

Continue reading for more on today's market, including:

- This retail stock is headed lower ahead of the holidays.

- Behind one Fintech giant's post-earnings peak.

- Plus, UWMC sees call surge; LGVN extends massive gains; and FL tumbles on supply chain issues.

UWM Holdings Corp (NYSE:UWMC) is at the top of the list of stocks seeing the most options volume at this point in the day. So far, 74,000 calls have crossed the tape, which is 37 times the amount typically seen at this point, alongside 12,000 puts. The November 7 call is the most popular, with new positions being opened there. UWMC is up 23.4% at $6.75 at last glance, after terminating a previously announced secondary offering of its common stock.

Near the top of the Nasdaq today is Longeveron Inc (NASDAQ:LGVN), up 51% to trade at $10.37 at last check, after earlier hitting a record high of $14.75. Today's pop has LGVN extending yesterday's impressive gains, as retail investors begin to take notice of the rally. The equity recently announced that the U.S. Food and Drug Administration (FDA) approved its Lomecel-B, for rare pediatric disease designation. LVGN has nearly tripled in price this week, and is headed for its biggest one-week jump since going public back in February.

Meanwhile, Foot Locker, Inc. (NYSE:FL) is tumbling on the New York Stock Exchange (NYSE), down 13.2% to trade at $49.95. Like many others, supply chain concerns are overshadowing the stock's upbeat third-quarter results today. This negative price action has FL breaking back below its 100-day moving average, though the 320-day trendline still lingers below as support.